Accounting basics in Odoo

Setting the configuration in your database is the first step in accounting. Some parameters to set up are:

- Accounting basic concepts

- Chart of accounts

- Journals

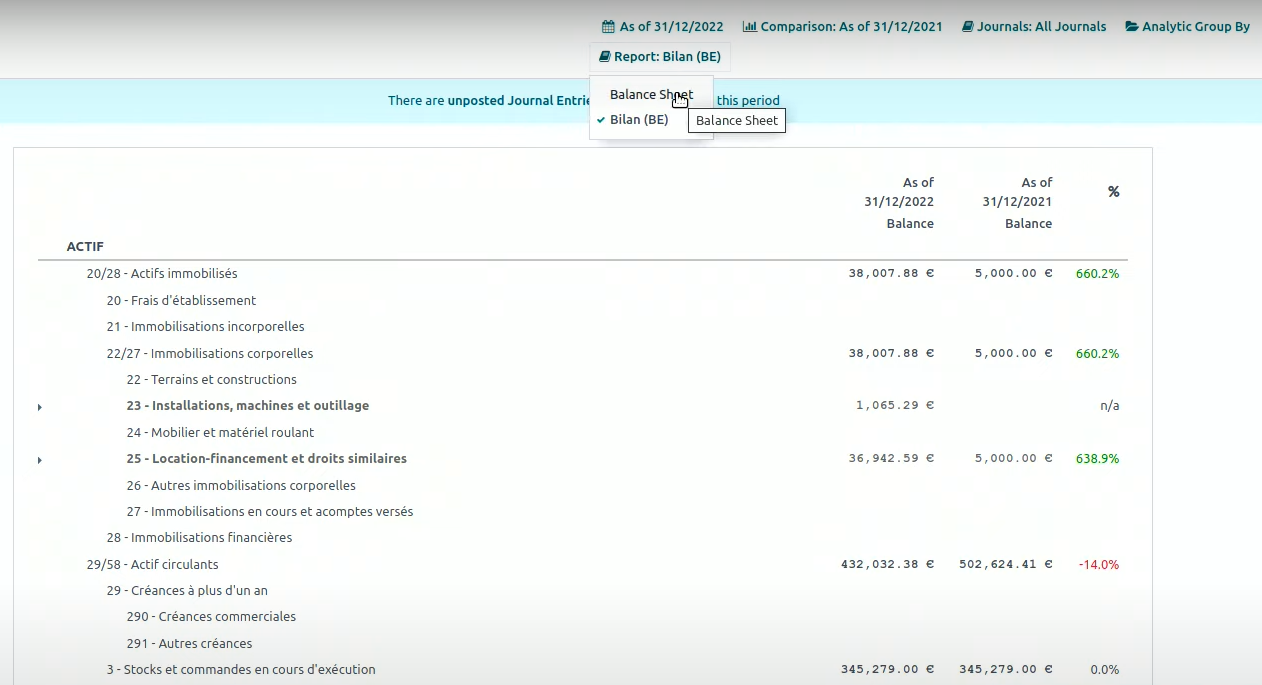

- Balance Sheet importing

INVOICES & BILLS - Customer Invoices

- Credit Notes

- Payment terms

- Terms and Conditions

- Vendor Bills

- OCR Document Digitization

- QR Codes

PAYMENT - Customer and Vendor Payments

- Online Payments

- Payment Follow-up

- Batch Deposit of Checks

- Cash discount

BANK AND CASH - Bank Configuration

- Bank Statements & Synchronization

- Bank reconciliation

TAXES - Taxes and VAT

- Cash basis

- Fiscal Positions

- Tax Report and Return

- Extra Taxes

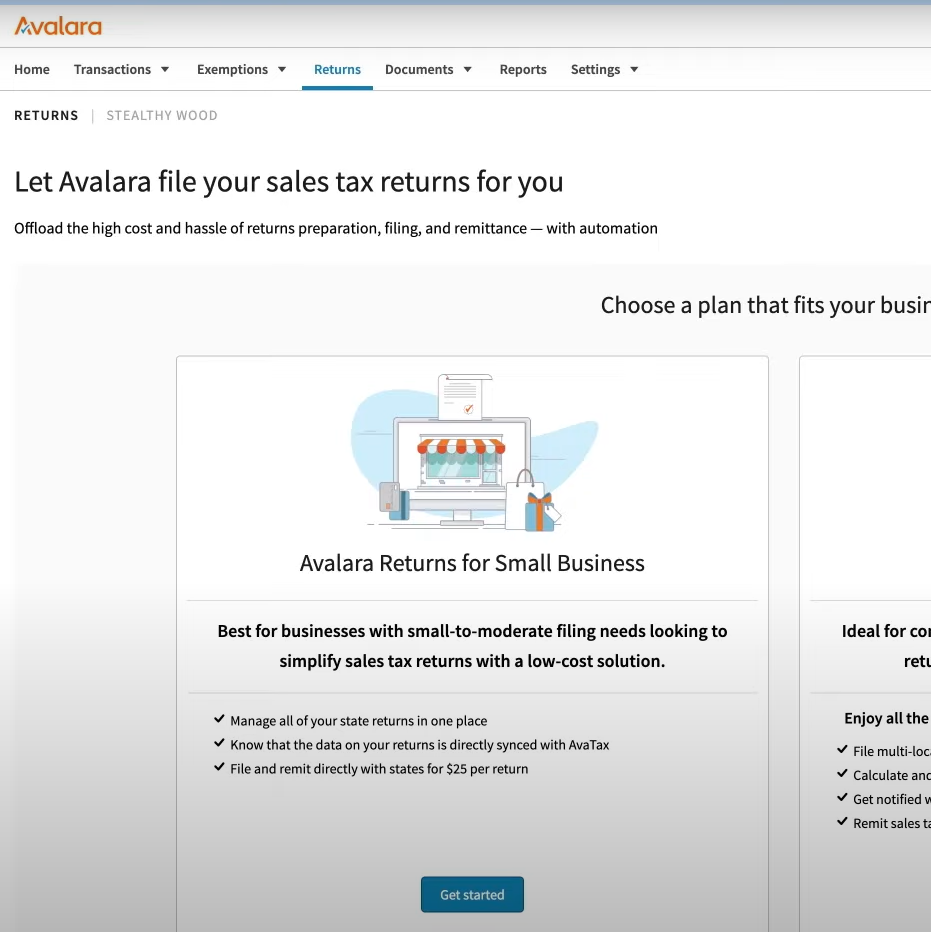

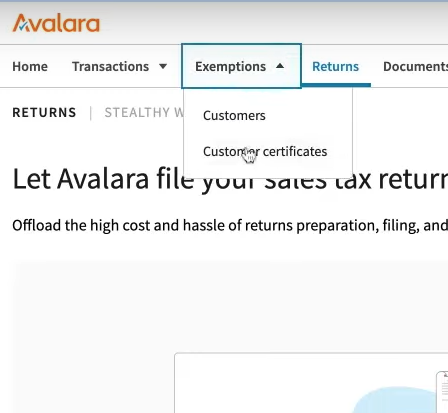

- Avatax (USA & Canada)

ACCOUNTING MANAGEMENT - Assets Management

- Deferred revenues and expenses

- Analytic Accounting

- Budget Management

- Multi company and Journal Groups

- Inventory Valuation

- Multi-currency - Gains/Losses

- Geographical localization

- Closing the fiscal year

- Reporting

In this section are shown concepts, tips and other valuable information to set the accounting module.

Debit vs Credit

This key concept in accounting is part of the module. Every transaction has a double entry in the system.

The next table explains how this works:

Debit | Credit | |

Active accounts | + | - |

Passive accounts | - | + |

Expense accounts | + | - |

Income accounts | - | + |

Reference: Odoo Youtube channel

Three main parameters

Chart of accounts, Journals and Taxes must be setup properly to have a good start at Odoo Accounting setup.

Internal Team

Company

CFO

Reporting

Monitoring financial health with:

Balance sheet, Profit & Loss, Analytic Accounting and Budgets.

Senior Accountant

Settings & Validation

Basic Setup: Chart of accounts, journals & taxes.

Validating inv / bills, process payments & general legal reports.

Accounting Assistant

Operational

Encoding of inv / bills, bank statements & payment follow-up.

External Stakeholders

Government

Authority

Control

Deep control for unreported revenue, tax inconsistencies and other similar situations.

Chartered Accountant

Closing

Review, make adjustments & book the closing.

Auditor

Checking

Ensures that statements are truthful and fair.

Types of accounts

EQUITY

What the company owns.

LIABILITIES

Obligations from past events.

BANK AND CASH

Money in banks or cash.EXPENSE

Cards to support the business.

FIXED AXETS

Long term wealth.

CURRENT ASSETS

Short term wealth.

INCOME

Revenue generated.

Configuration

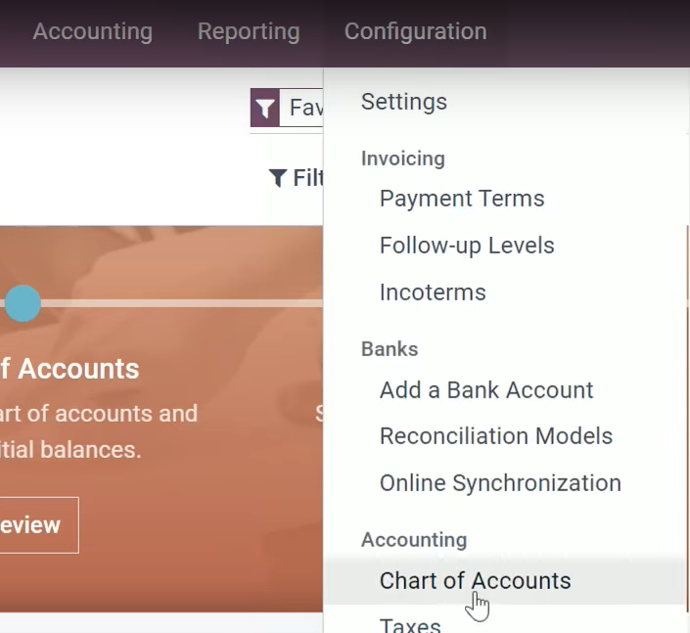

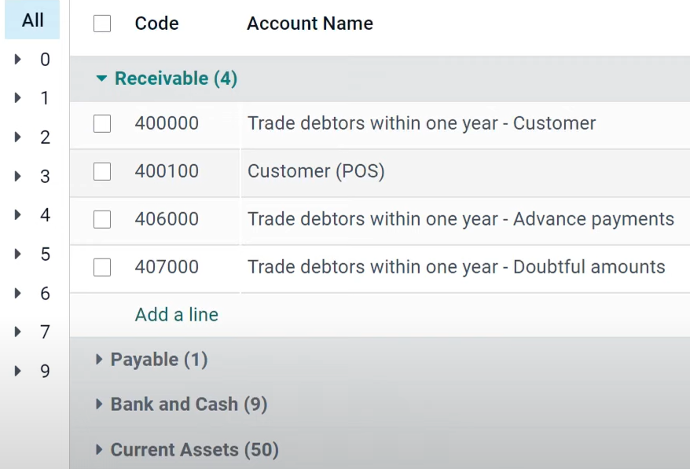

Config. - Chart of accounts

Columns

Columns - unique codes - account name - type

Group accounts

Accounts can be grouped to facilitate their view

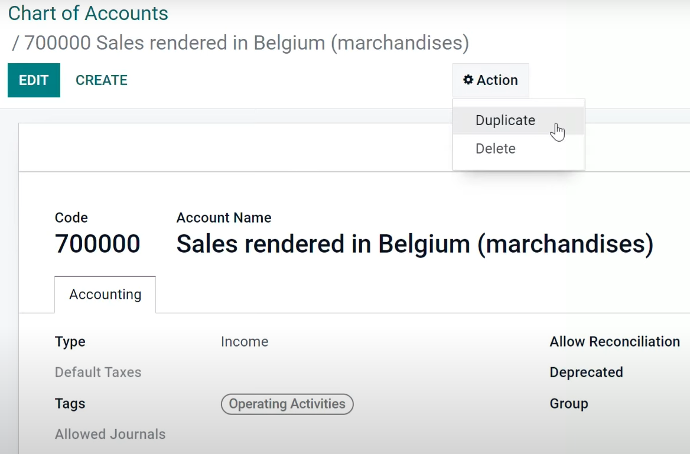

Duplicate accounts

Good practice - duplicate similar accounts

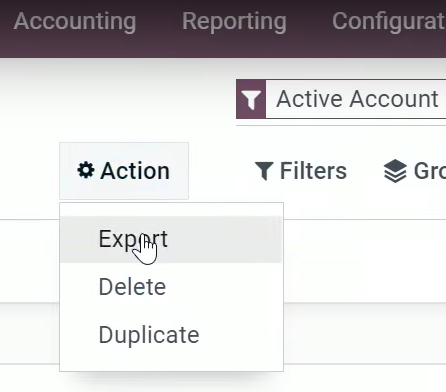

Export

Select all and export all chart of accounts

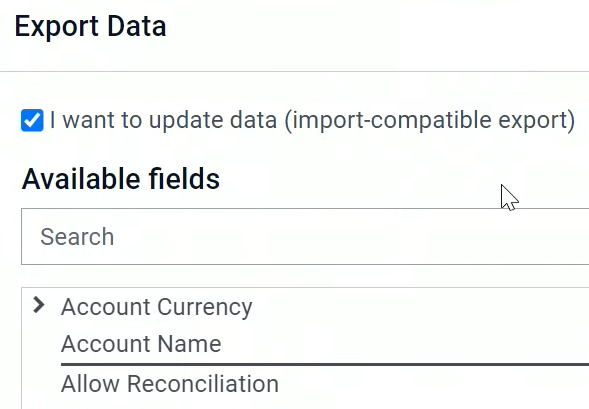

Update

update data checkbox / select deprecated field

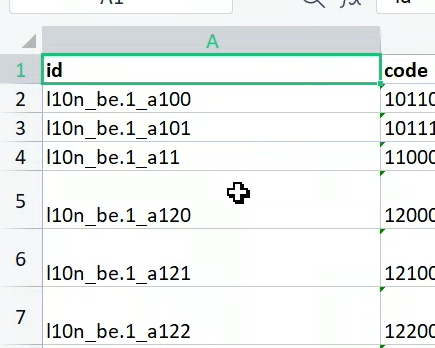

ID

The external ID is a unique code for each account

Archive

Don't delete accounts / Deprecated is to archive accounts

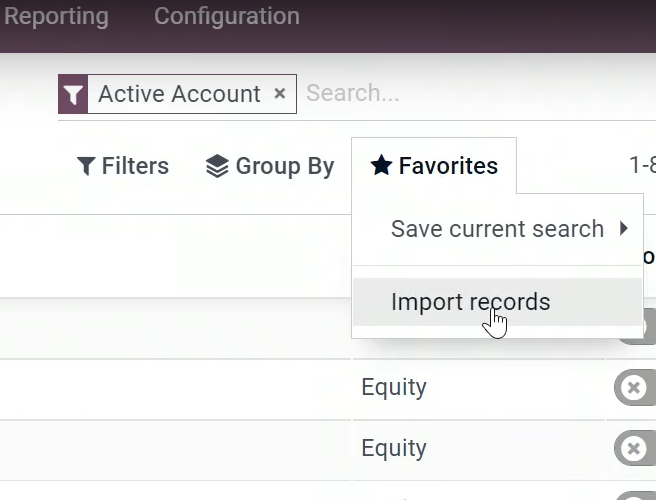

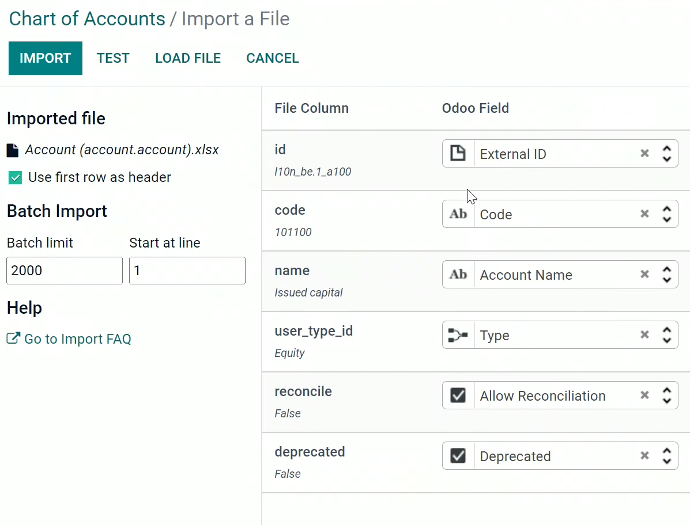

Import

Import file with favorites button

Fields

Confirm fields to import

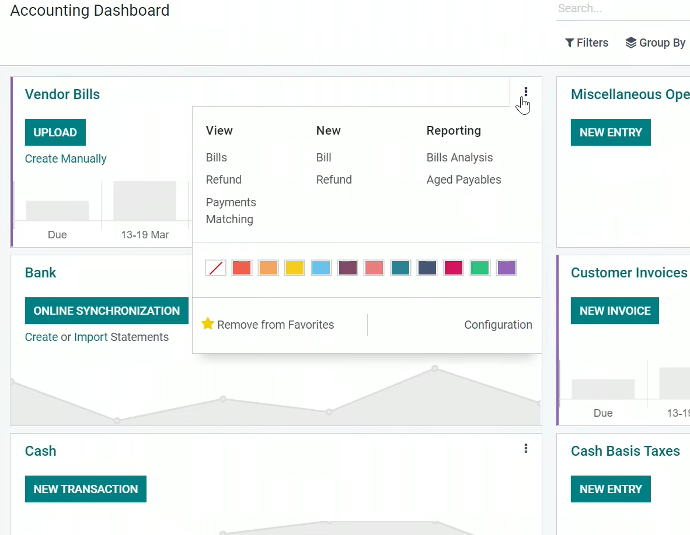

All contained in general ledger

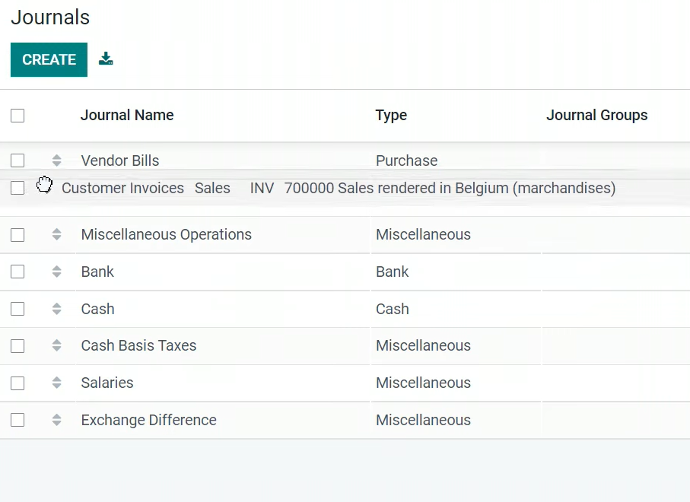

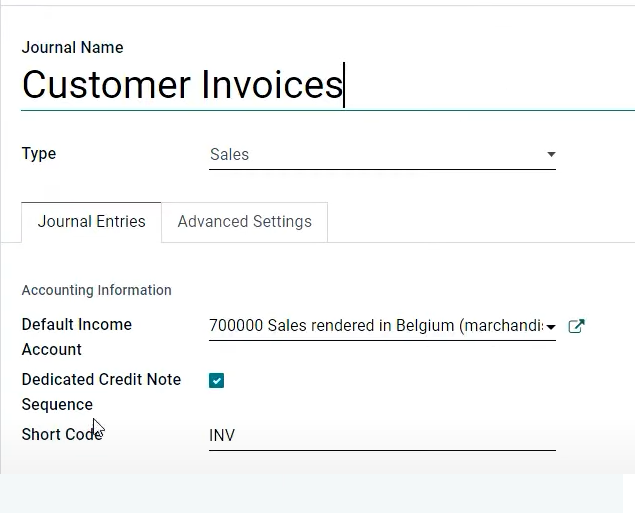

Main Journals set are

Vendor Bills / Miscellaneous Operations / Bank / Customer Invoices / Cash

Recommendation: have as few journals as possible

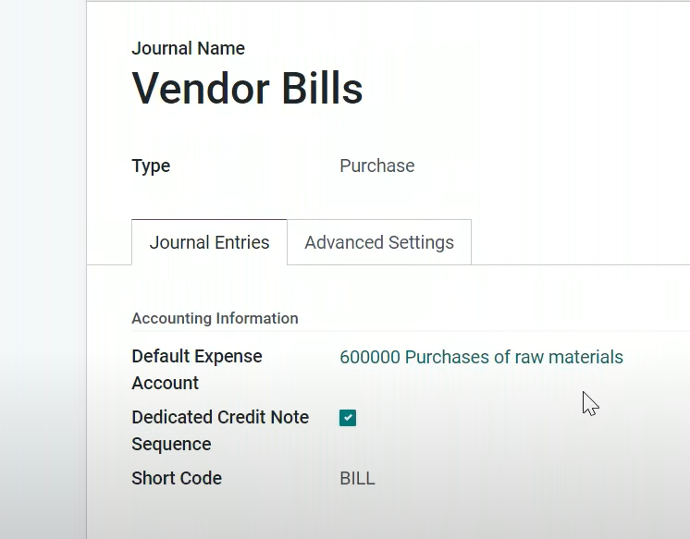

Configuration

Settings menu

Main setup

Dedicated credit note sequence + short code + type

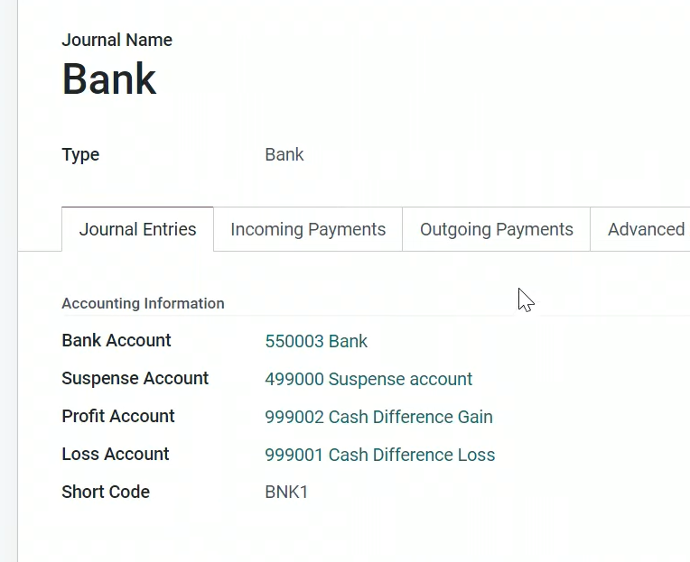

Bank journal

More accounts to be set

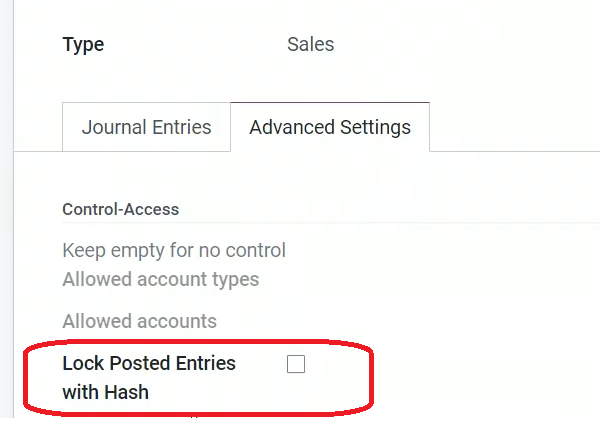

Adv. settings

Lock posted entries with Hash to prevent future modifications

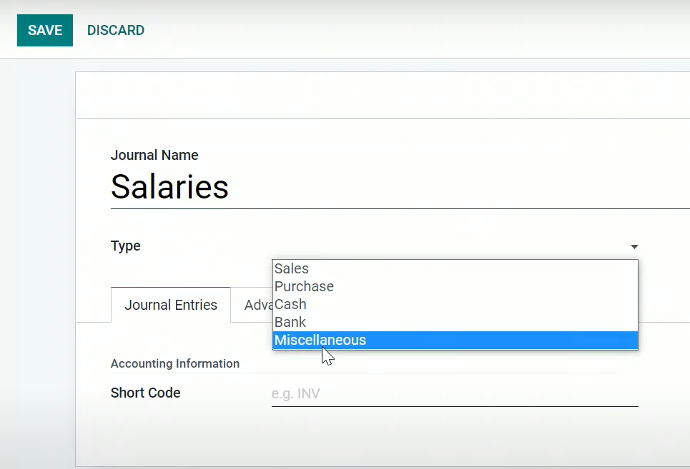

Create one

I.e. create salaries journal + short codes

Rearrange

Drag and drop

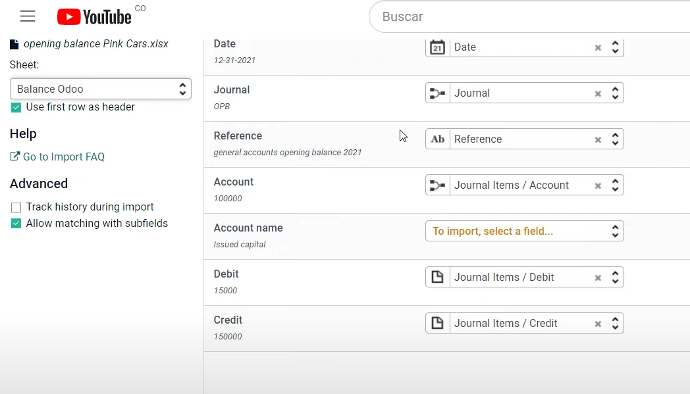

- It is proper to select end of fiscal year or tax period to import the balance sheet

- Three balances should be uploaded (GL, customer, Vendor) - that generates journal entries to be unbalanced

- to balance the entries, a suspense account is used

- Debits vs Credits = ZERO

do not put any zeros in credit or debit

GL Balance

Sum of all debits and credits

Debit | Credit | |

Receivable | $300 | |

Payable | $700 | |

Suspense Account | $400 |

Customer Balance

Receivable account represents the total debit of the customers Balance

Debit | Credit | |

Customer 1 | $100 | |

Customer 2 | $200 | |

Suspense Account | $300 |

Vendor Balance

Payable account is the total credit of the vendors balance

Debit | Credit | |

Vendor 1 | $300 | |

Vendor 2 | $400 | |

Suspense Account | $700 |

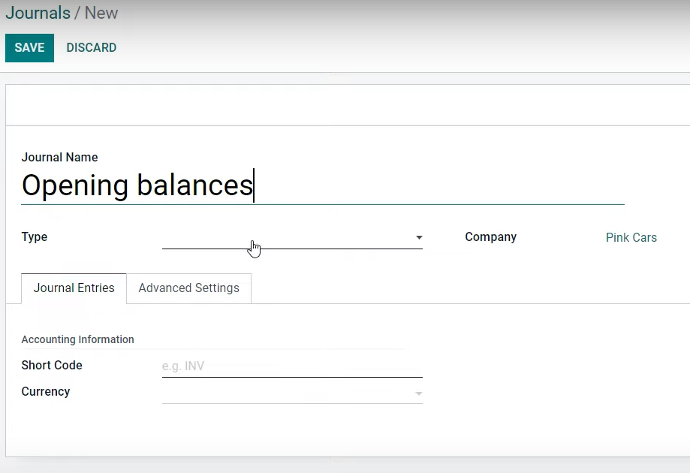

Opening Balance

Specify columns with date, name and reference for each opening balance

Date | Journal | Reference |

12.31,2023 | Opening Balances (OPB) | General Accounts |

Journals

Dedicate journals for opening balance

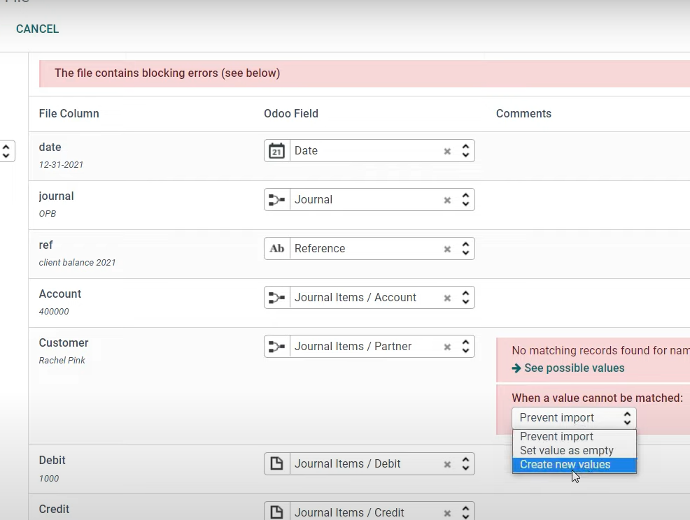

Import records

Test the data before

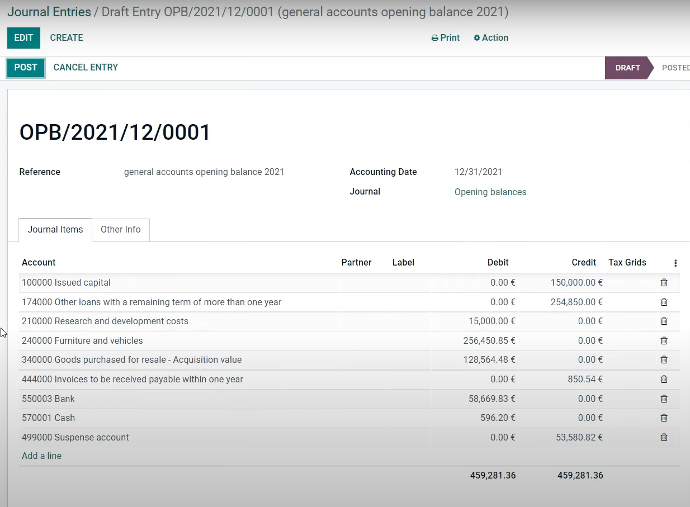

Journal entries

Detail with all GL accounts

Match records

Create new records if not existing

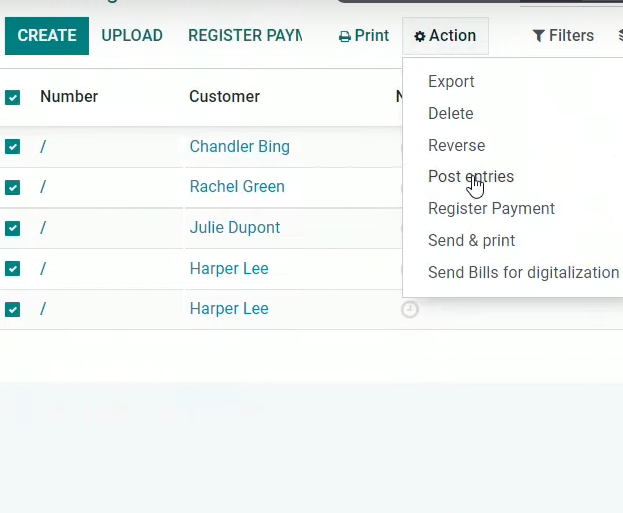

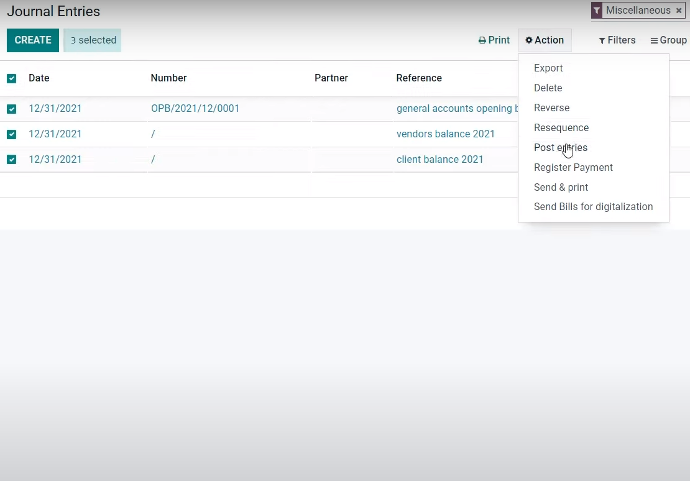

Post entries

Create new records if not existing, Can post several entries at once

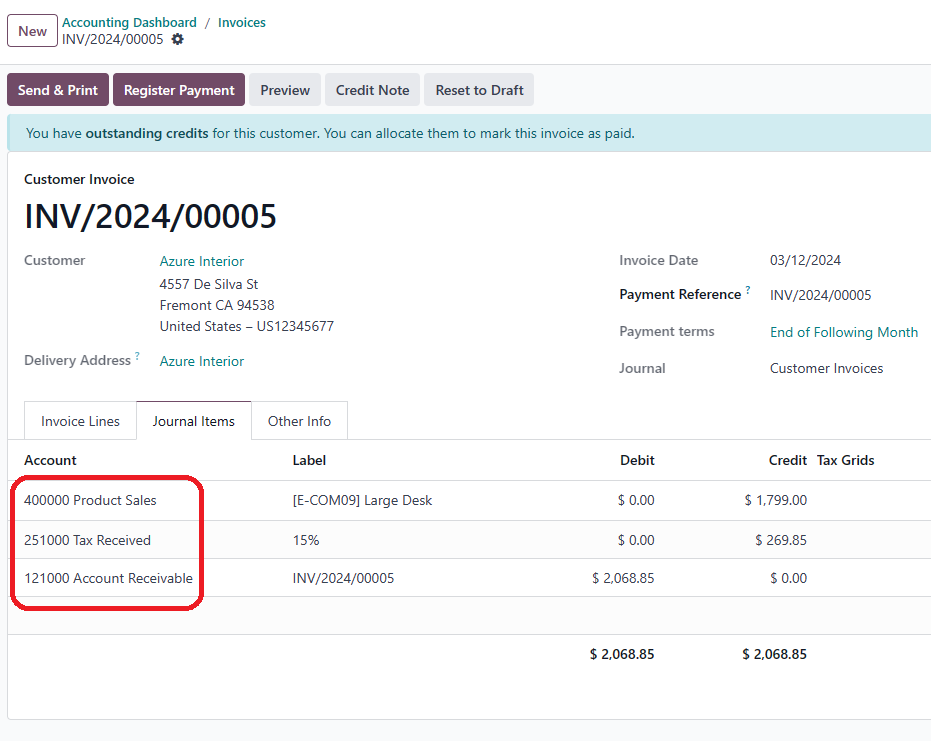

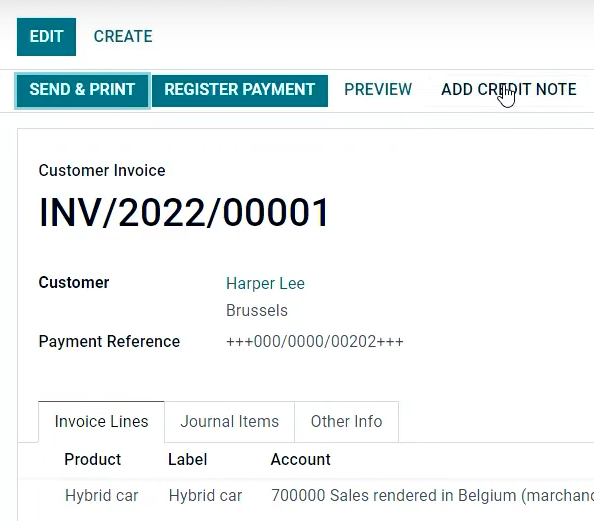

Invoice with 1 product

Journal items created are:

3 Lines: Product Sales, Tax Received, Account Receivable

A debit in Account Receivable defines the amounts your customer owes you

Sections and notes: added to an invoice to improve its structure.

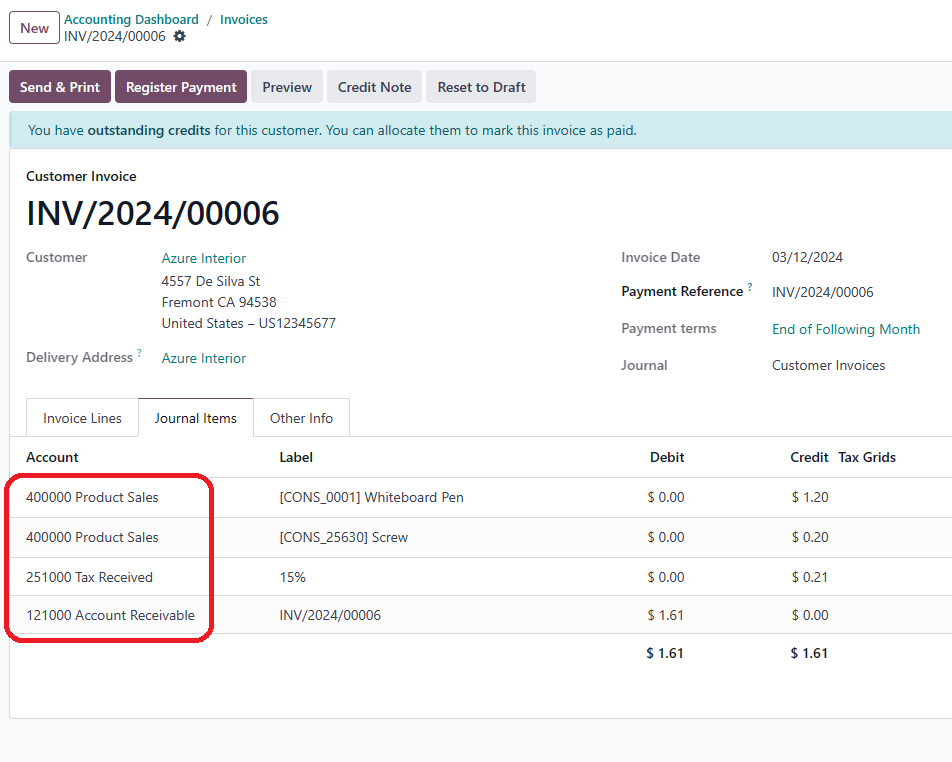

Invoice with 2 different products

Journal items created are:

1 Receivable, 2 Sales, 1 Tax

On the product, or the product category, or the journal:

define the default income account that is used on an invoice.

Is it possible to select all "Draft" invoices and post them in one action.

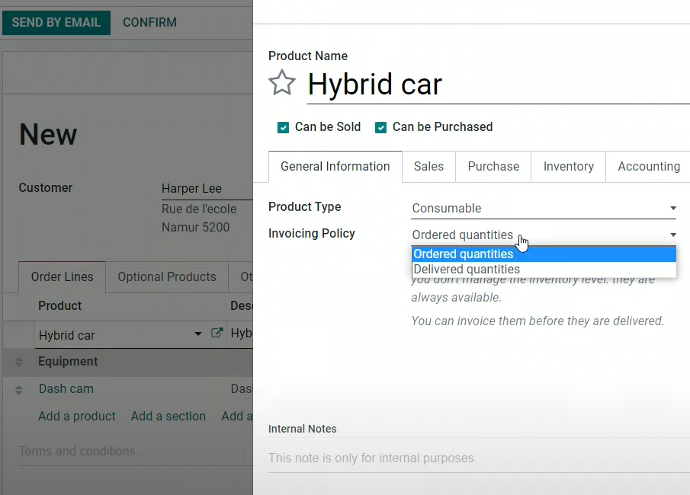

Invoicing method

Invoice based on

-Quantity delivered

-Quantity ordered

Blue means that a line product can be invoiced / gray products (have not been delivered) can not be invoiced

More than one invoice can be created for one order - i.e. you have more than one delivery for the same invoice

Types of invoice payment

Regular Invoice - [Down Payment (%) or Fixed amount]

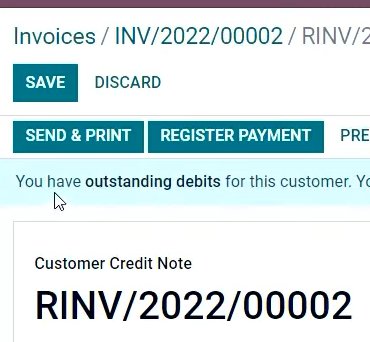

Credit Note is the reverse transaction of an Invoice

Must set the Sales Journal Configuration

- Click Dedicated Credit note sequence

- The Short code will be taken for the CN

Add a credit note in an Invoice

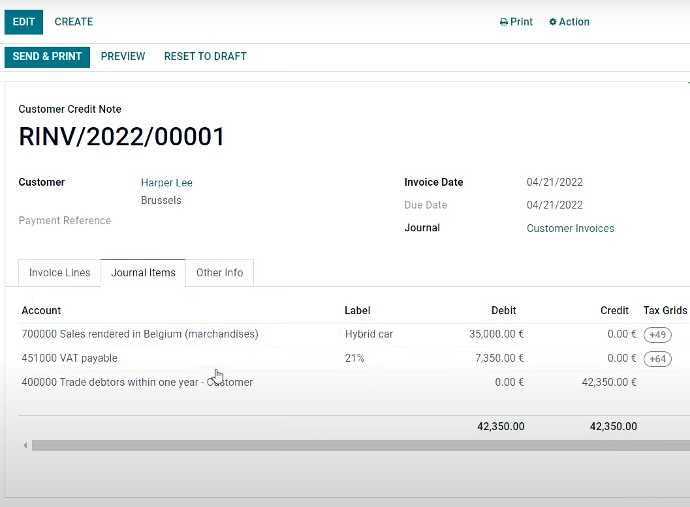

Debit vs Credit in a Credit Note

With an Invoice

Debit | Credit | |

Income Account | $100 | |

Receivable Account | $100 |

With a Credit Note

Debit | Credit | |

Income Account | $100 | |

Receivable Account | $100 |

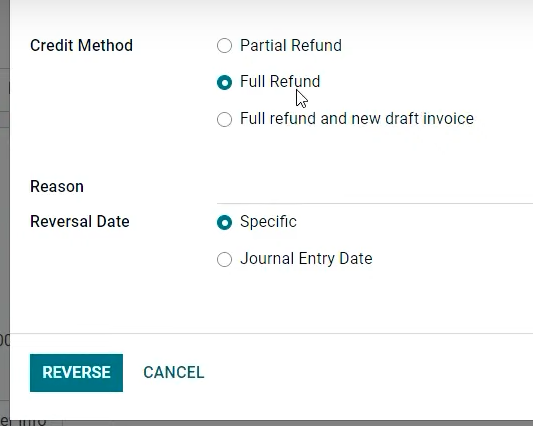

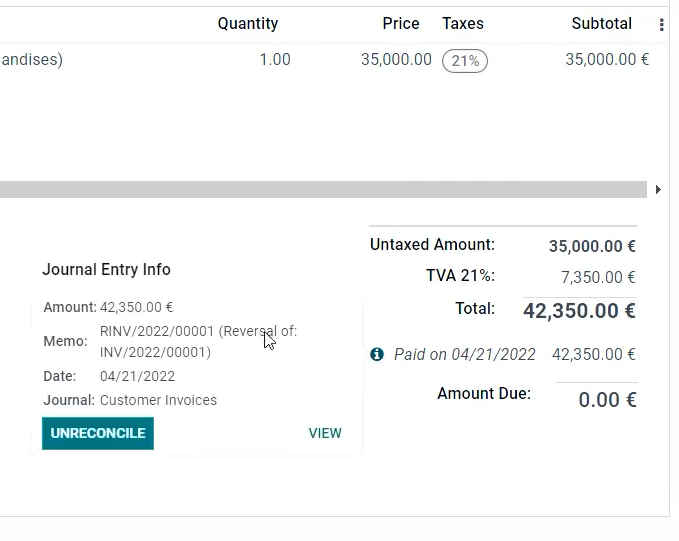

Total refund

Full Refund

Full or partial refund / reason and reverse

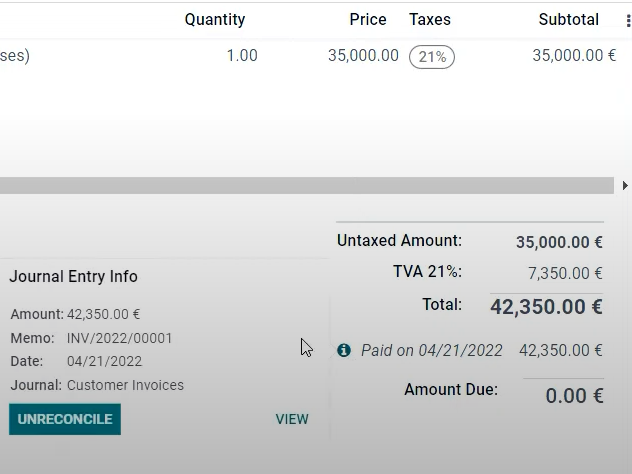

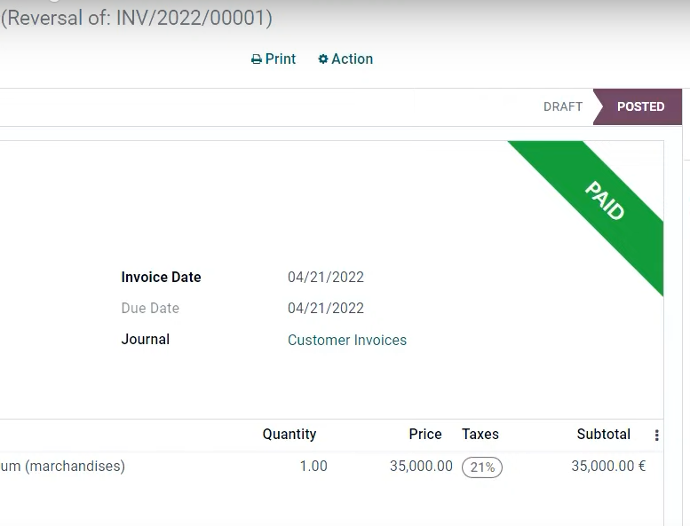

Reconciled

Confirm so the dedicated sequence is automatically posted, paid and reconciled

Journal items

Journal items are reverse of an invoice

Reversed

The invoice gets reversed

Reversed reconciliation

Amount due gets reversed

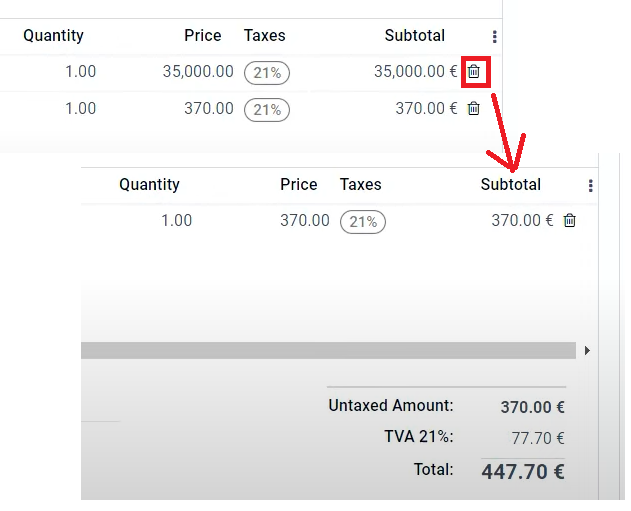

Partial refund

Partial Refund

Generate a partial refund

Modify product lines

Take out one of the product lines (in the credit note, not in the invoice)

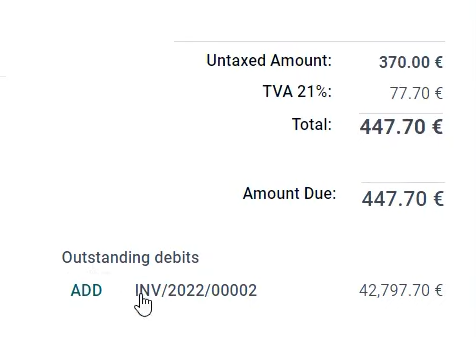

Add debits

Outstanding debits - click add

In Odoo V 17 this step is not necessary

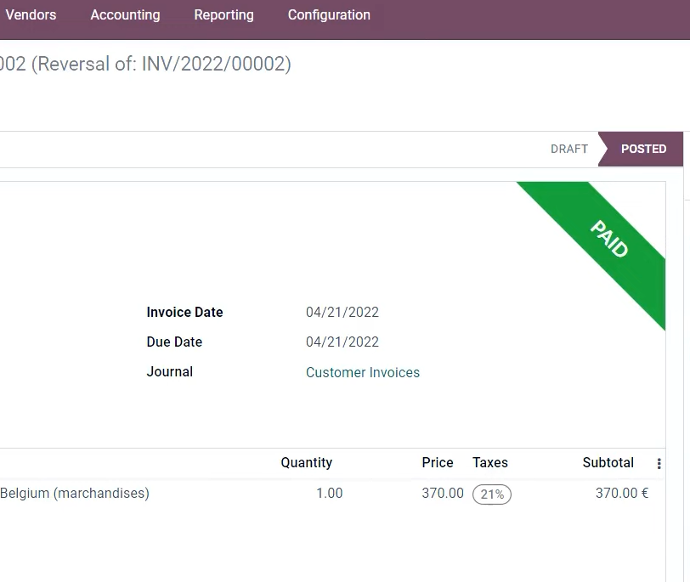

Paid

Credit note is paid and posted

Reversed reconciliation

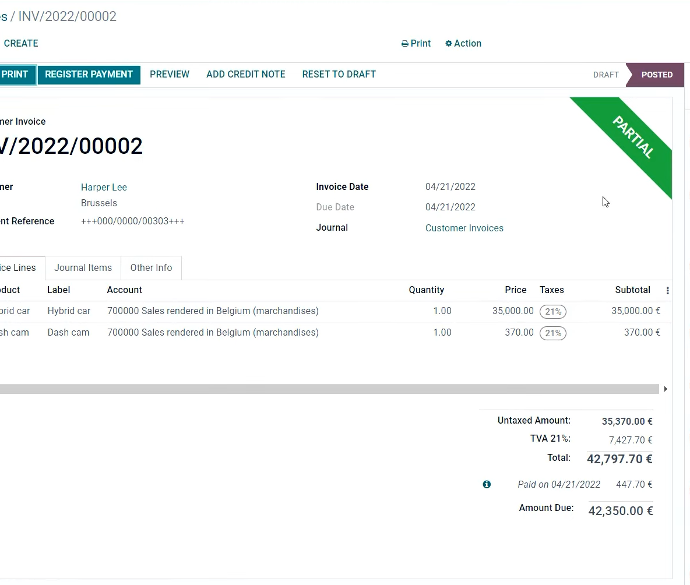

original INV not reversed but partially paid

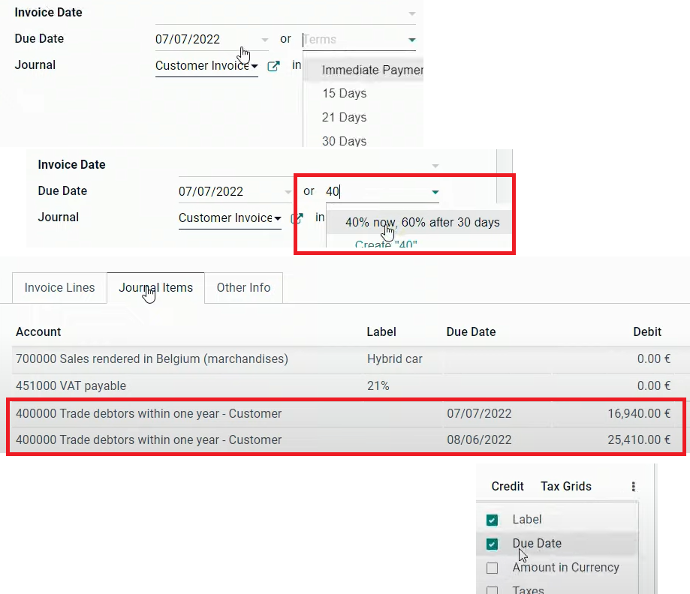

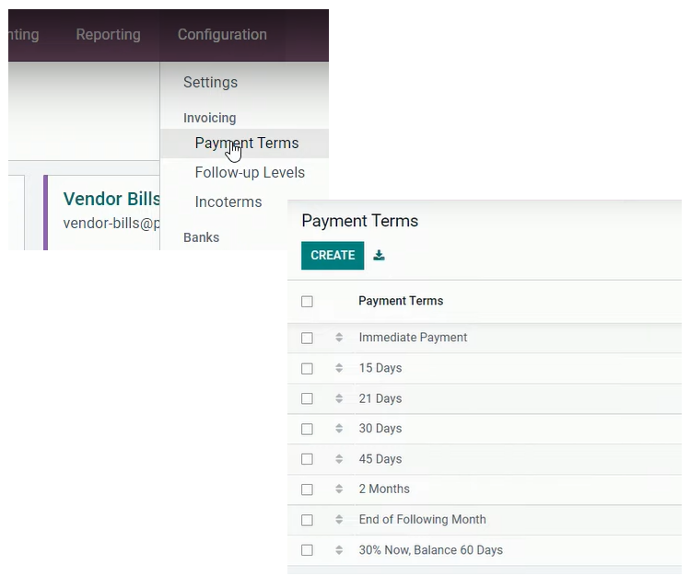

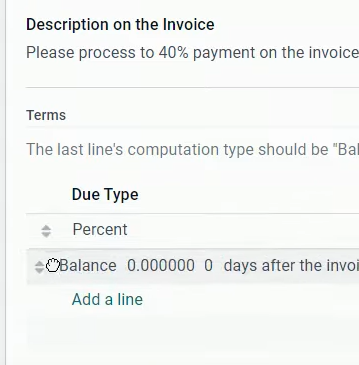

Payment terms

Go to settings / Accounting - payment terms

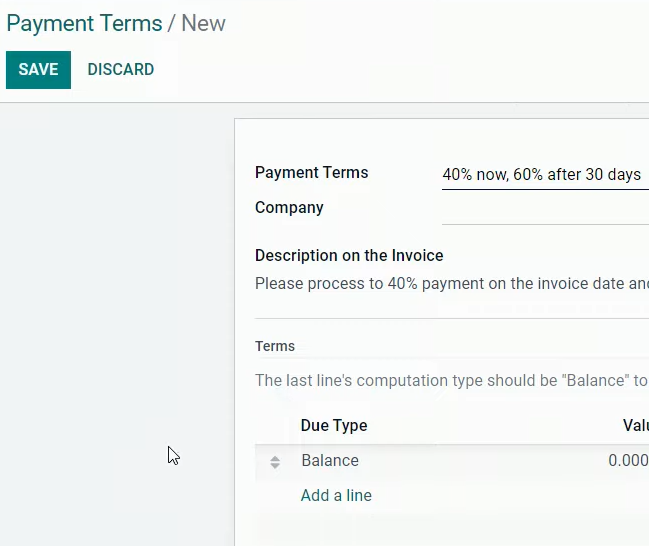

Creation

Create if necessary, add a description - can select company

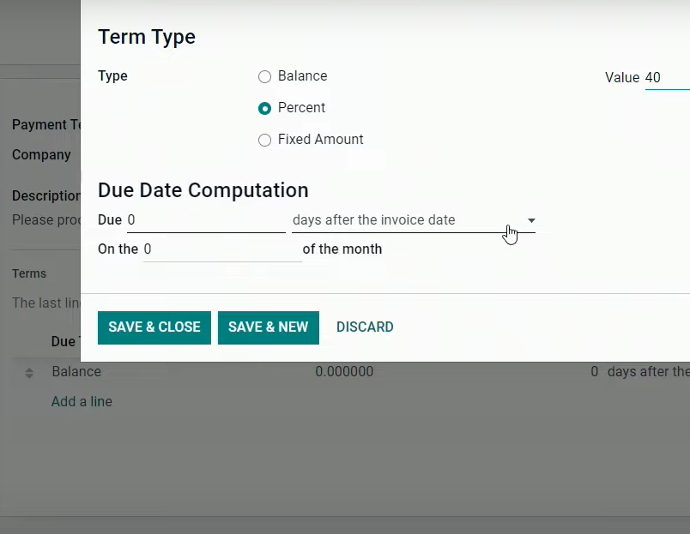

Set Percentage

Set percentage and due date if needed

View is more direct in Odoo v17

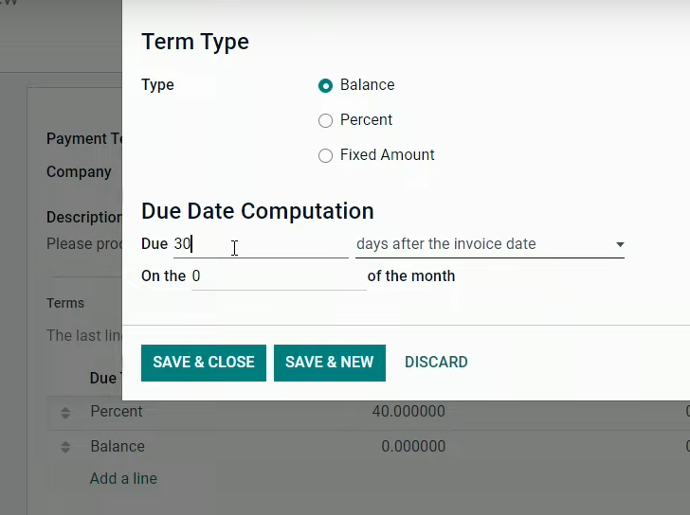

Balance

Locate the balance at the bottom

Balance was replaced by the remaining percentage cor Odoo v17

Balance due date

Put the balance due date at or the number of days needed

Balance was replaced by the remaining percentage cor Odoo v17

Invoice date

If invoice date changes, automatically changes the second payment due date

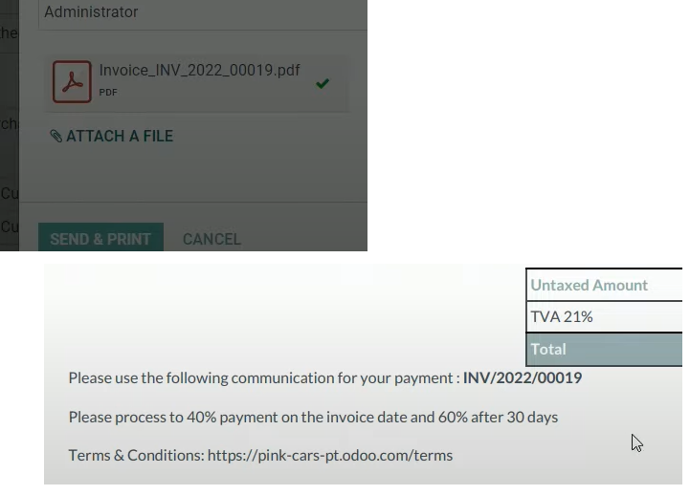

Invoice PDF sent

Invoice in sent with the PMT term note

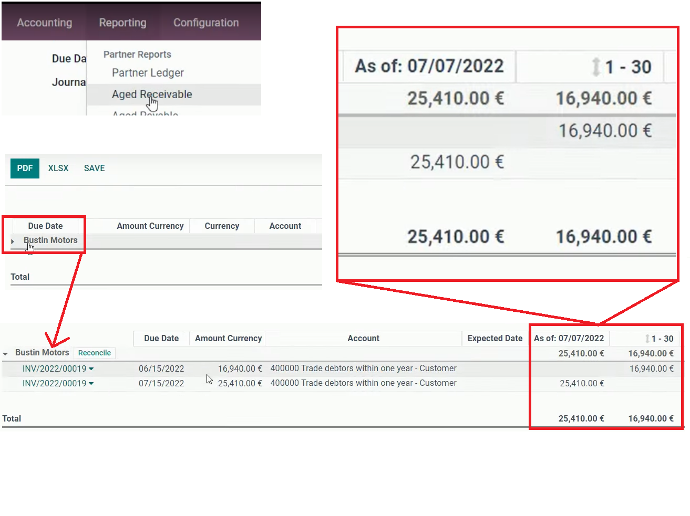

Receivable report

Consult the aged receivable report

Two lines separated are generated for the same invoice

One item to reconcile

In the Bank Journal there is one item to reconcile - validate

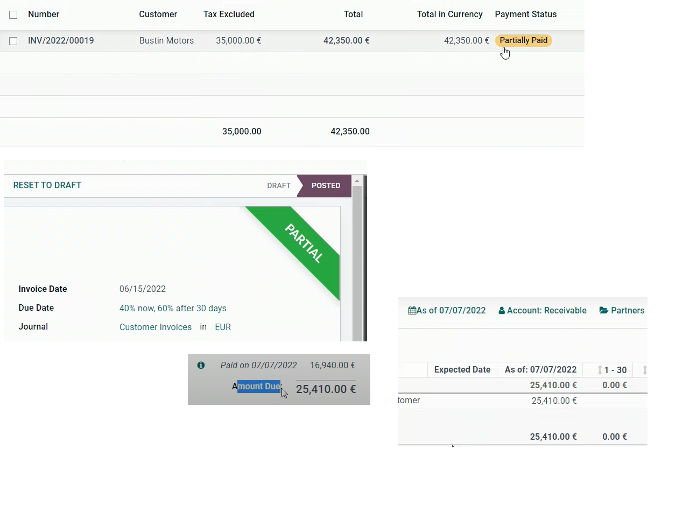

Partially paid

The payment status is partially paid

The aged receivable appears only the second payment pending

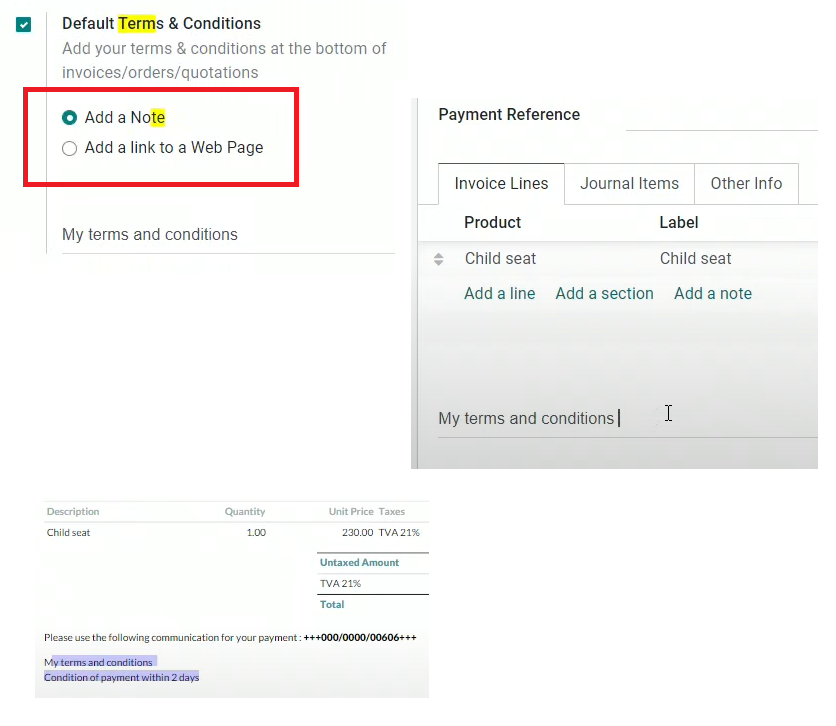

Invoice T&C

Activate in Accounting / Settings.

Add a note or a link to a web page for large T&C.

Below the invoice terms and conditions are displayed.

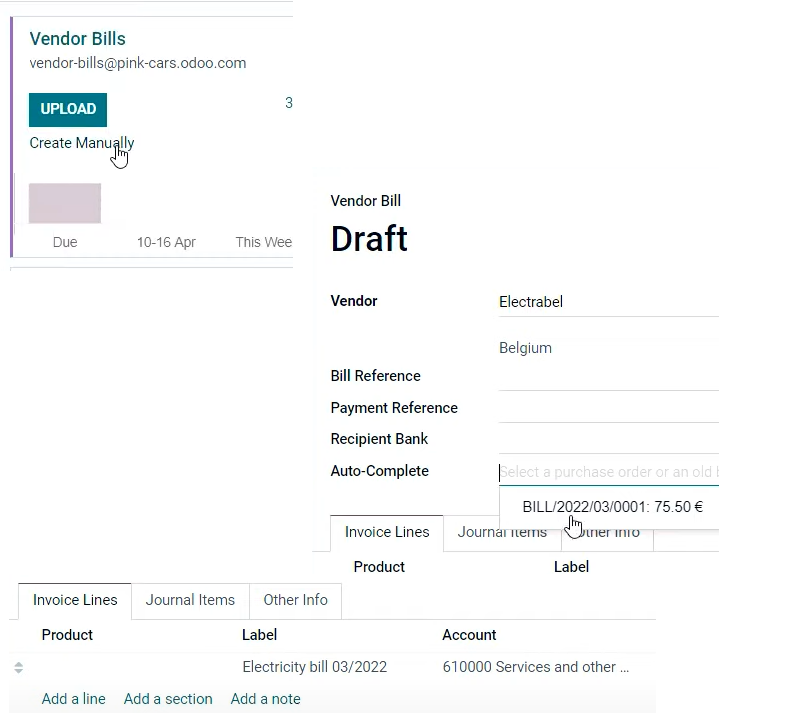

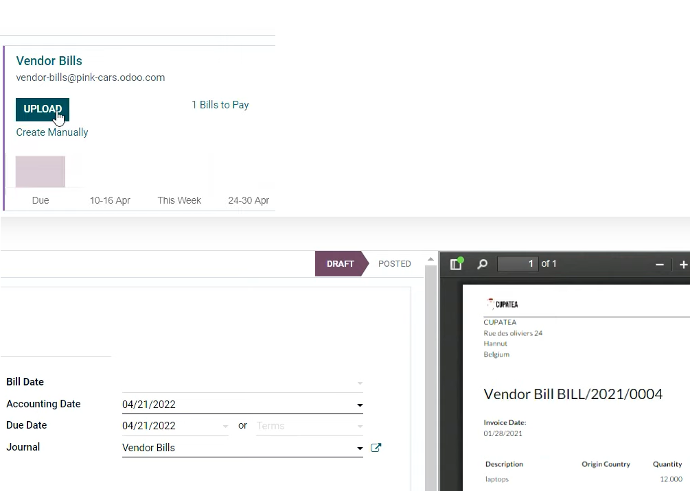

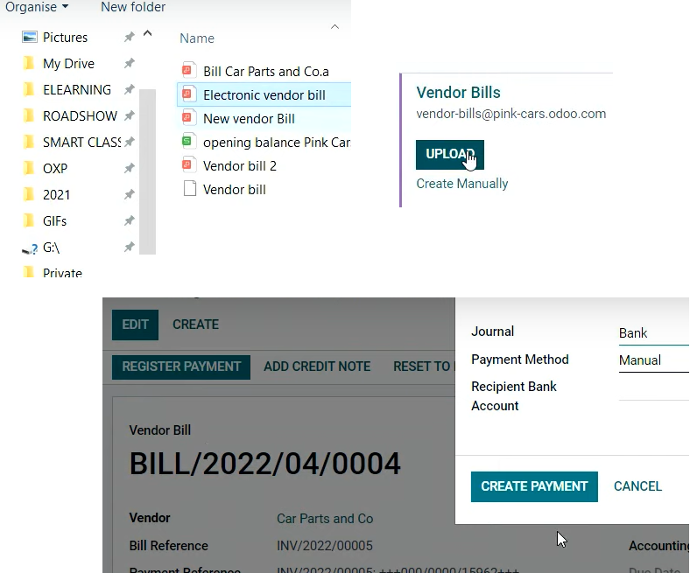

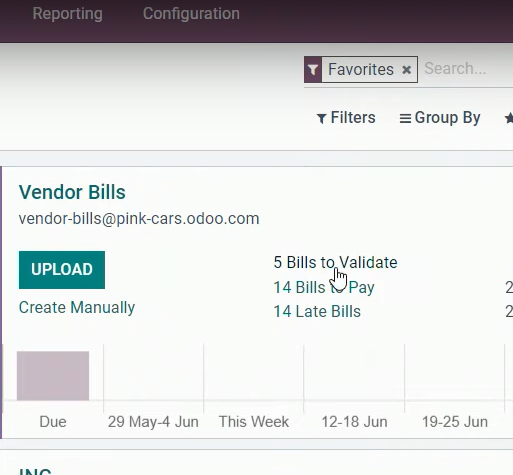

Upload

Avoid having multiple pdf associated o a vendor bill.

When you receive an email odoo creates a vendor bill

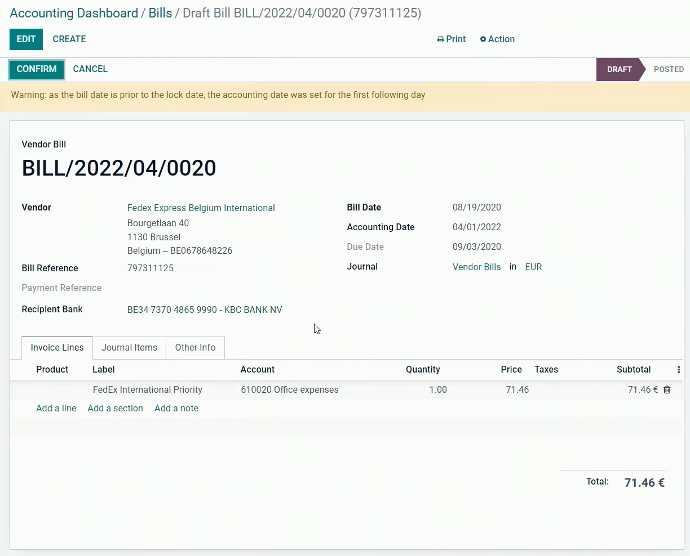

Can upload one

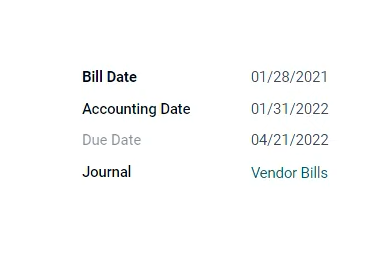

Date

Bill date is the document date and the Accounting date is when it gets accounted for.

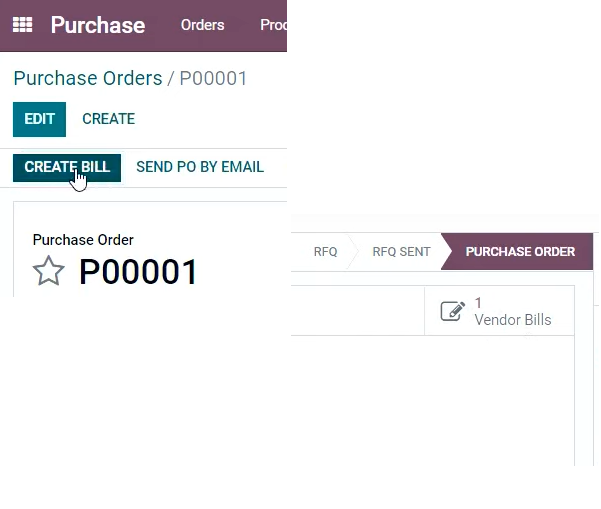

Bill from a PO

Create bill from the PO

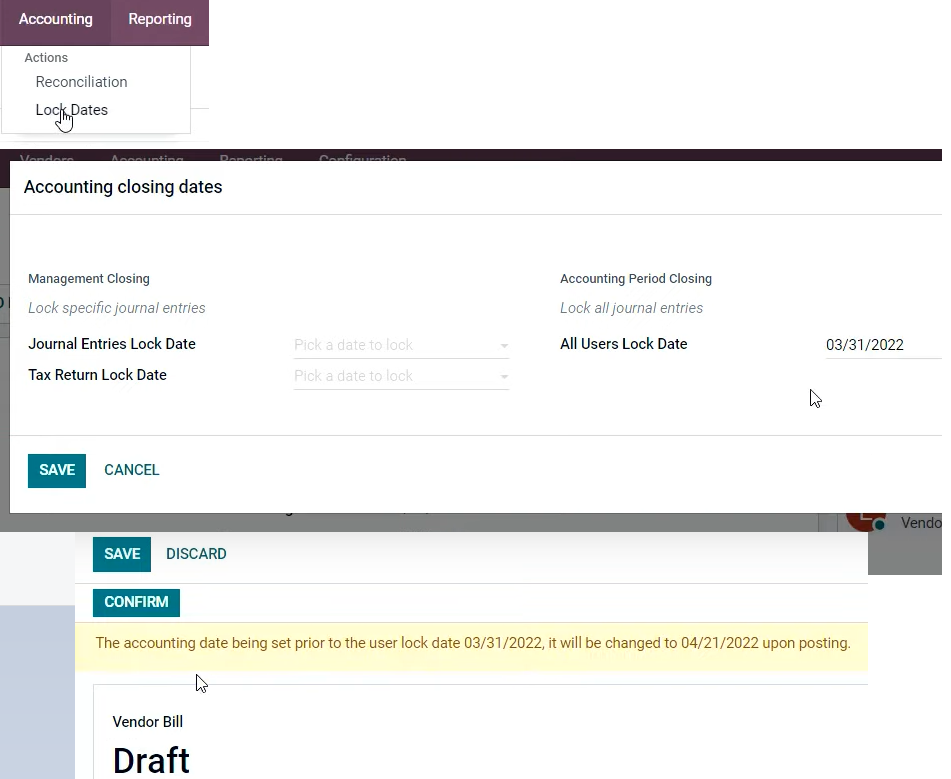

Lock period

Lock period: not permission to create vendor bills after certain date

system blocks the date

XML - Electronic Invoicing

Might upload an electronic invoicing with a vendor bill: pdf with XML behind with fields information

Then can register the payment

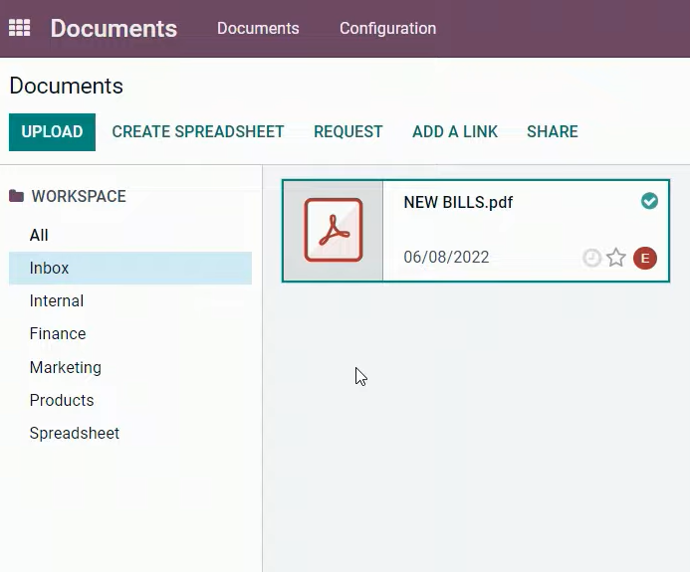

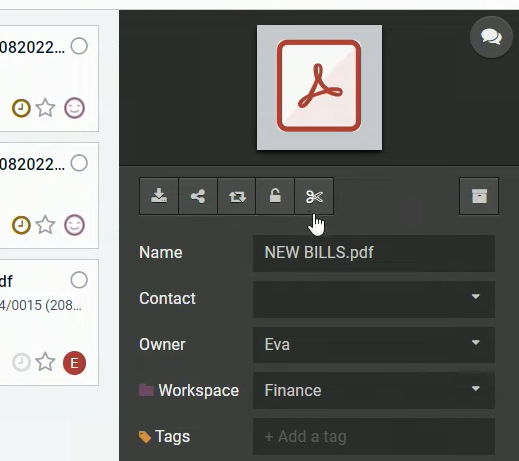

Documents

Upload doc to Documents Module

Finance

Put the pdf in the finance workspace

Split

Click scissors icon to split document (if multiple bills in one PDF)

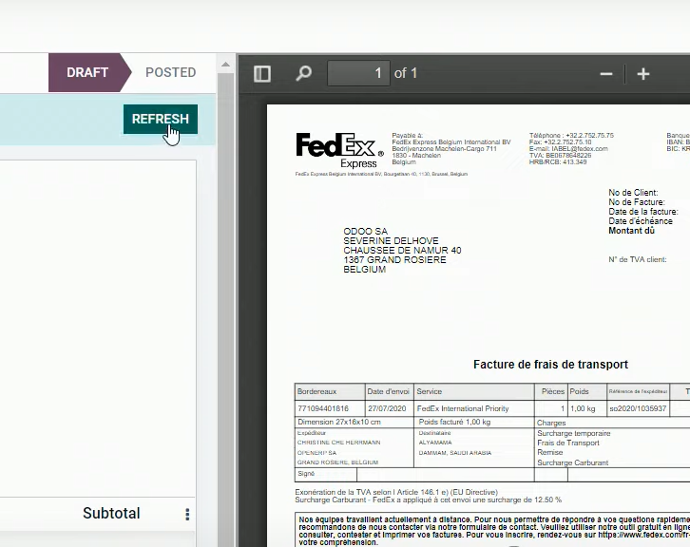

OCR

Scan bills to validate from OCR

Refresh

Press refresh button to have the info available

Recognize

Recognized info

After recognizing bills, you can post entries

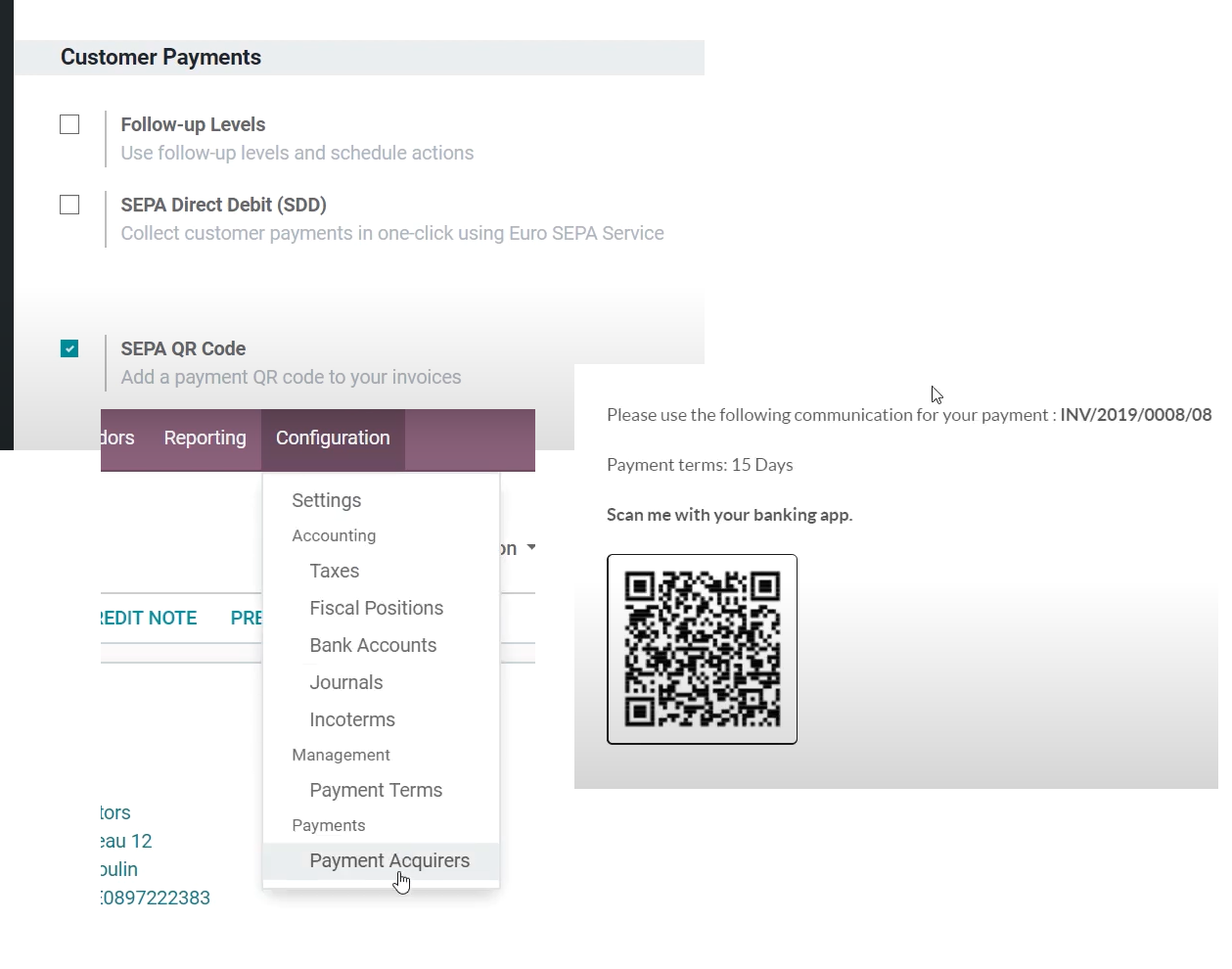

SEPA QR

Used for European countries

Set the Bank account / create bank

Configure SEPA QR in customer Payments

Set in Configuration / Payment Acquirers / Wire Transfer

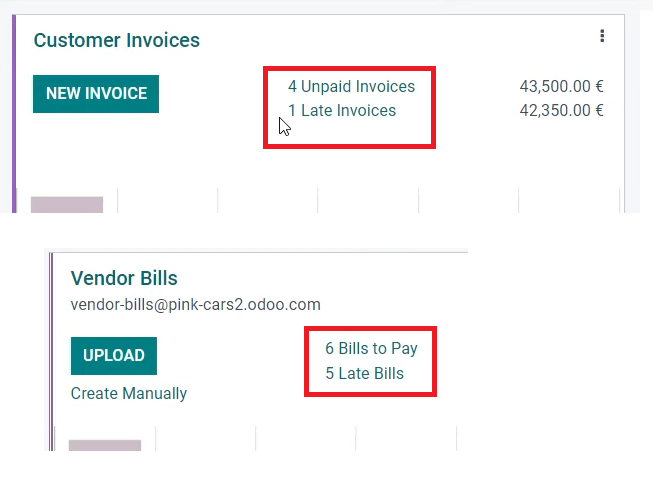

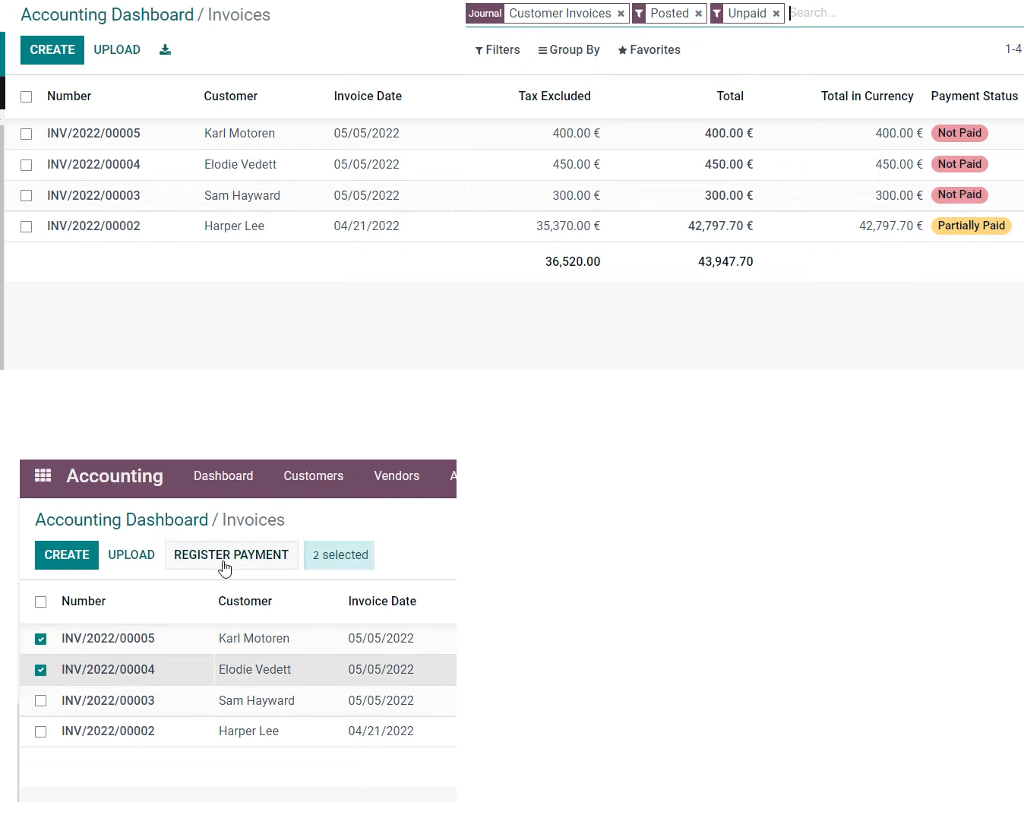

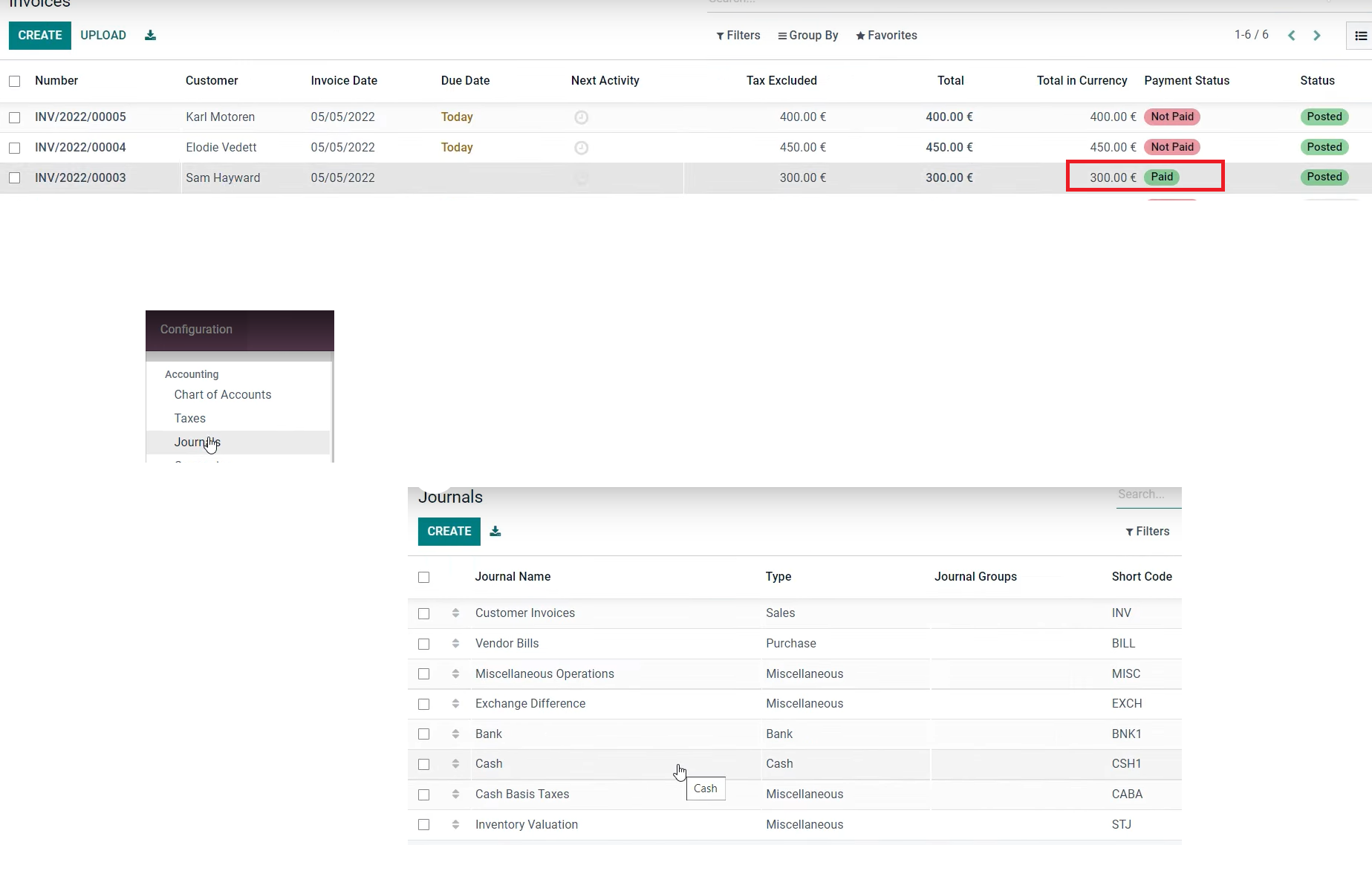

| -check INV & Bills that are late _______________________________ -can register multiple PMTs |

|

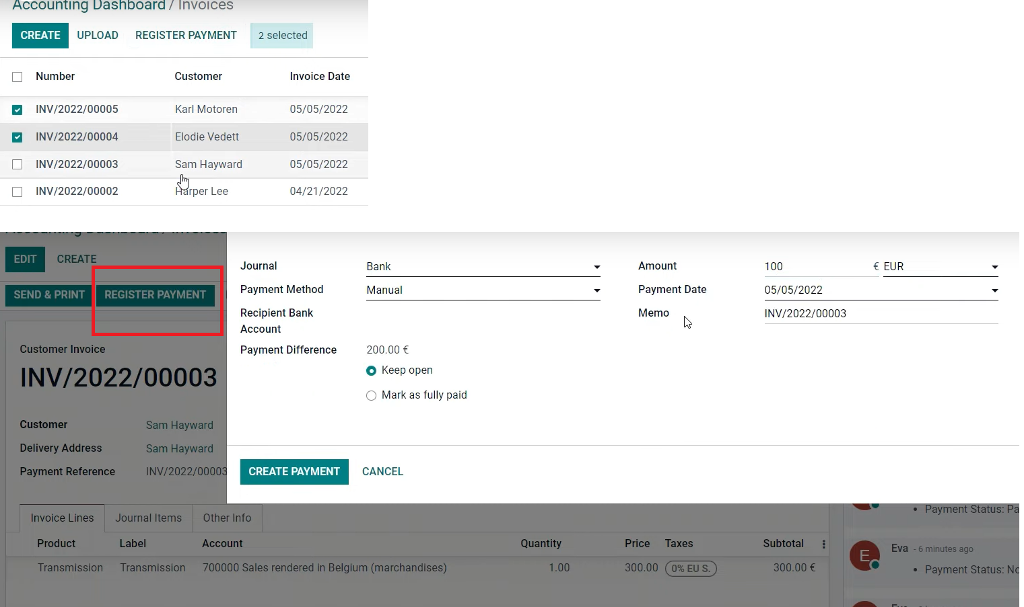

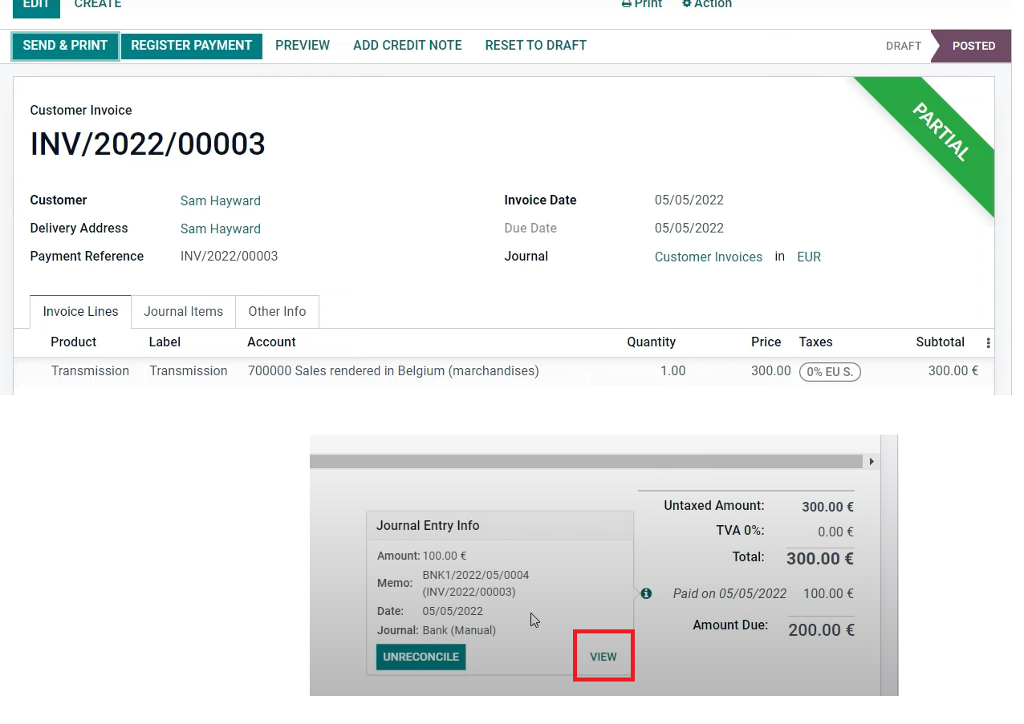

| -can also select one INV to pay -partial PMT created _______________________________ -check PMT details below -select view button for details |

|

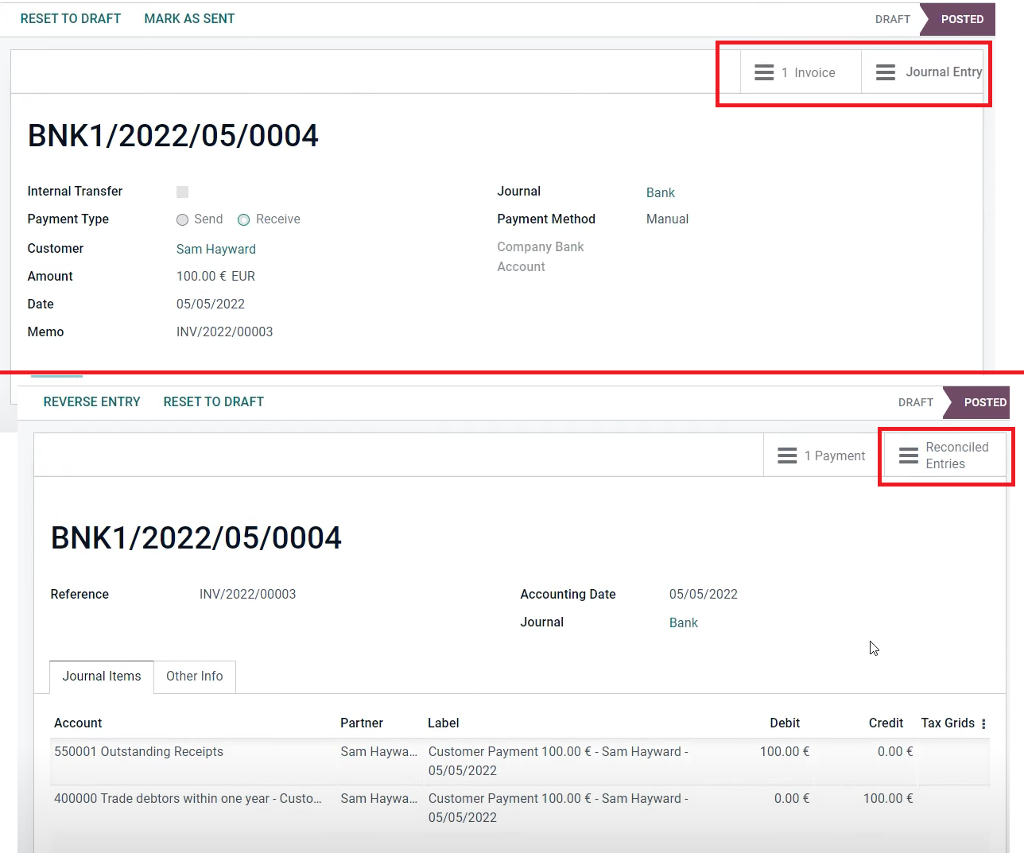

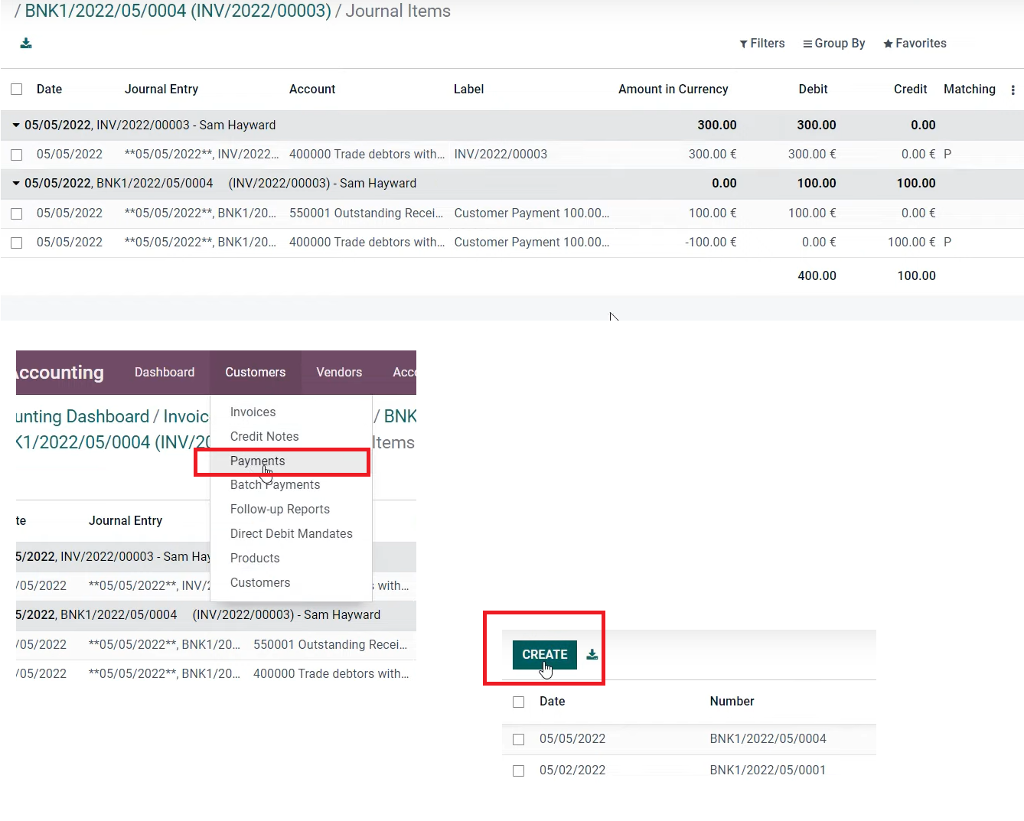

| -Now Journal and other details are displayed -debit and credit for journal entries -see the impact with reconciled entries _______________________________ -see reconciled PMTs -create PMT from scratch |

|

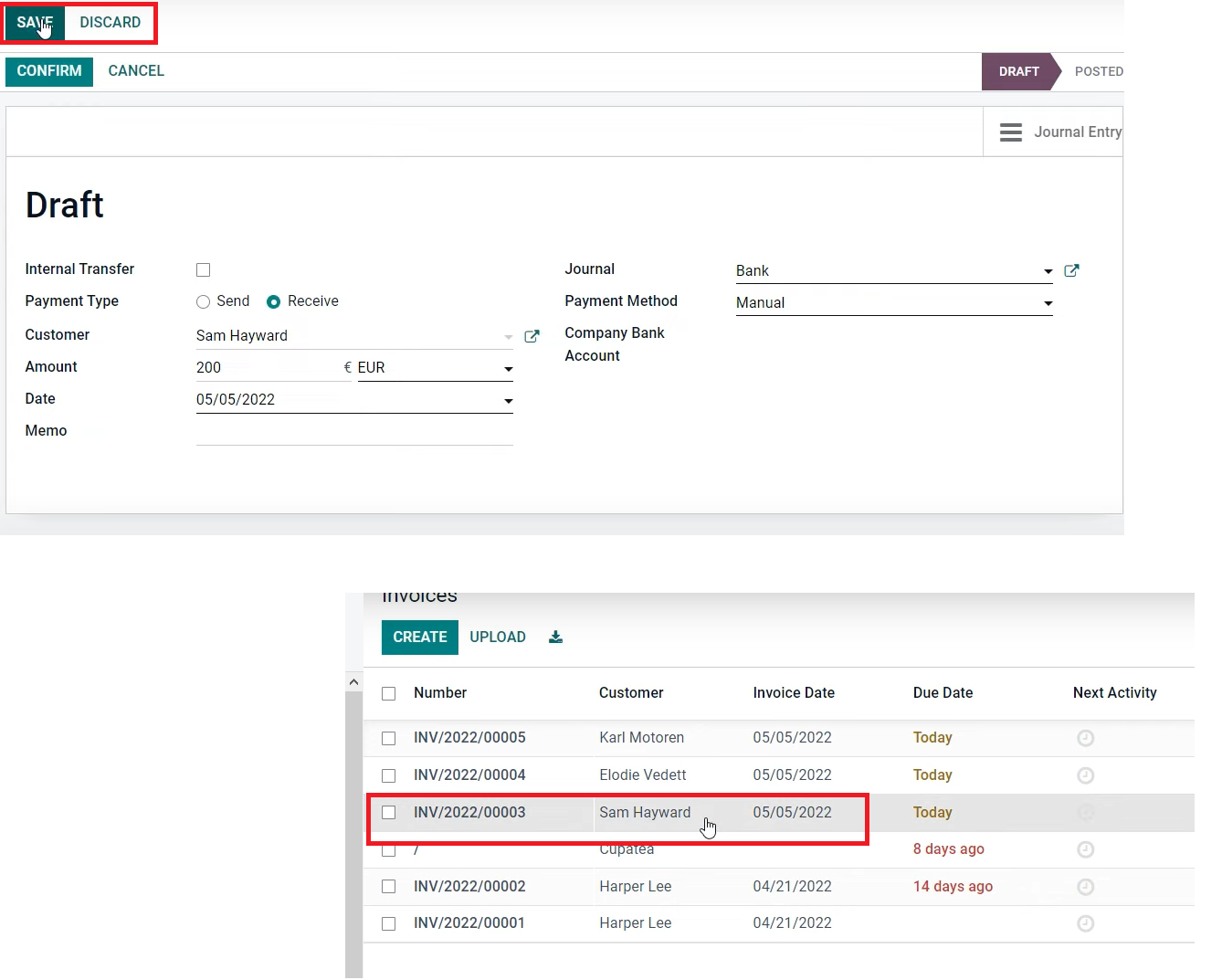

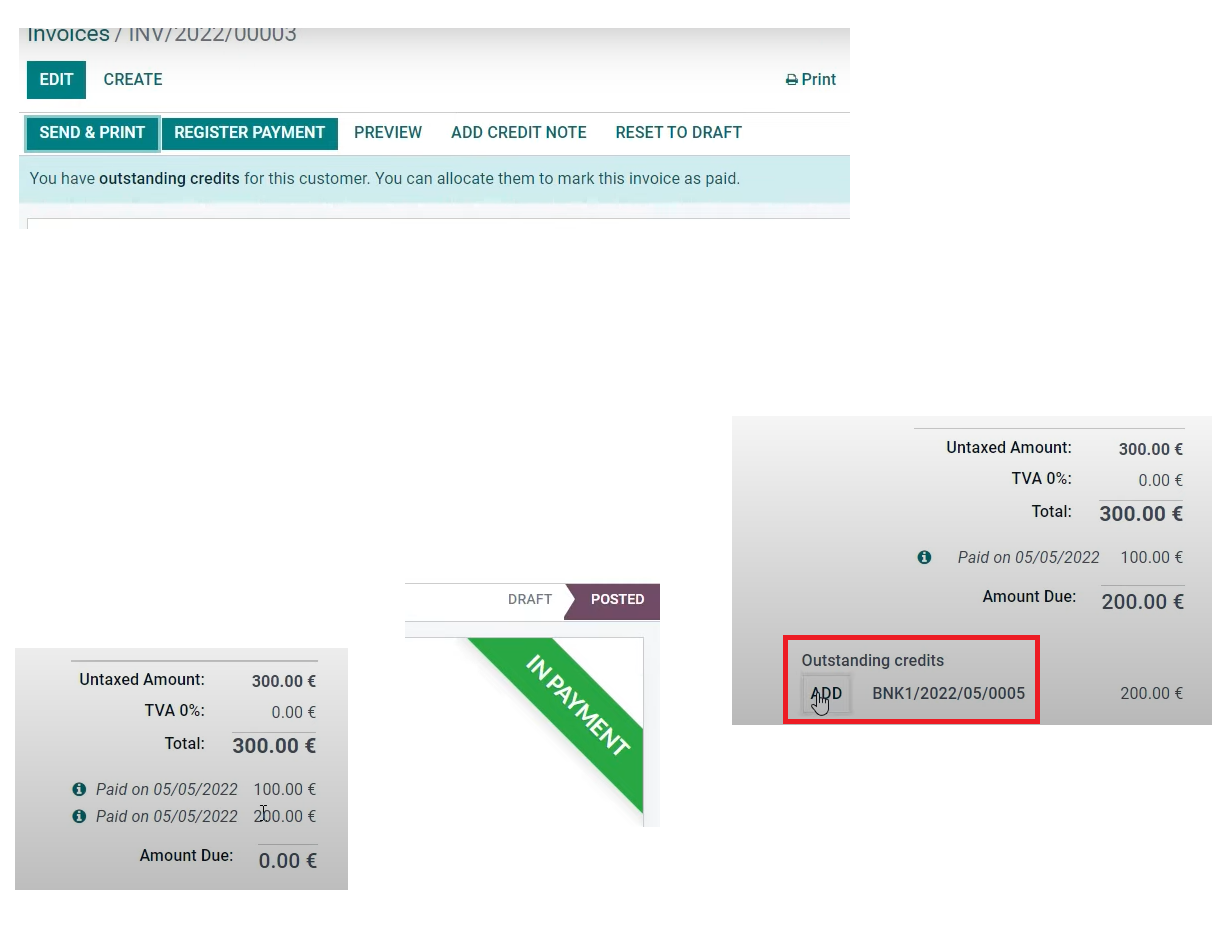

| - Register PMT (unreconciled) -go to invoiced to select the related INV _______________________________ -blue note: outstanding credits displayed, add PMT -In Payment stage for transit accounts (outs. cred.) -when reconcile with BNK, automatically paid |

|

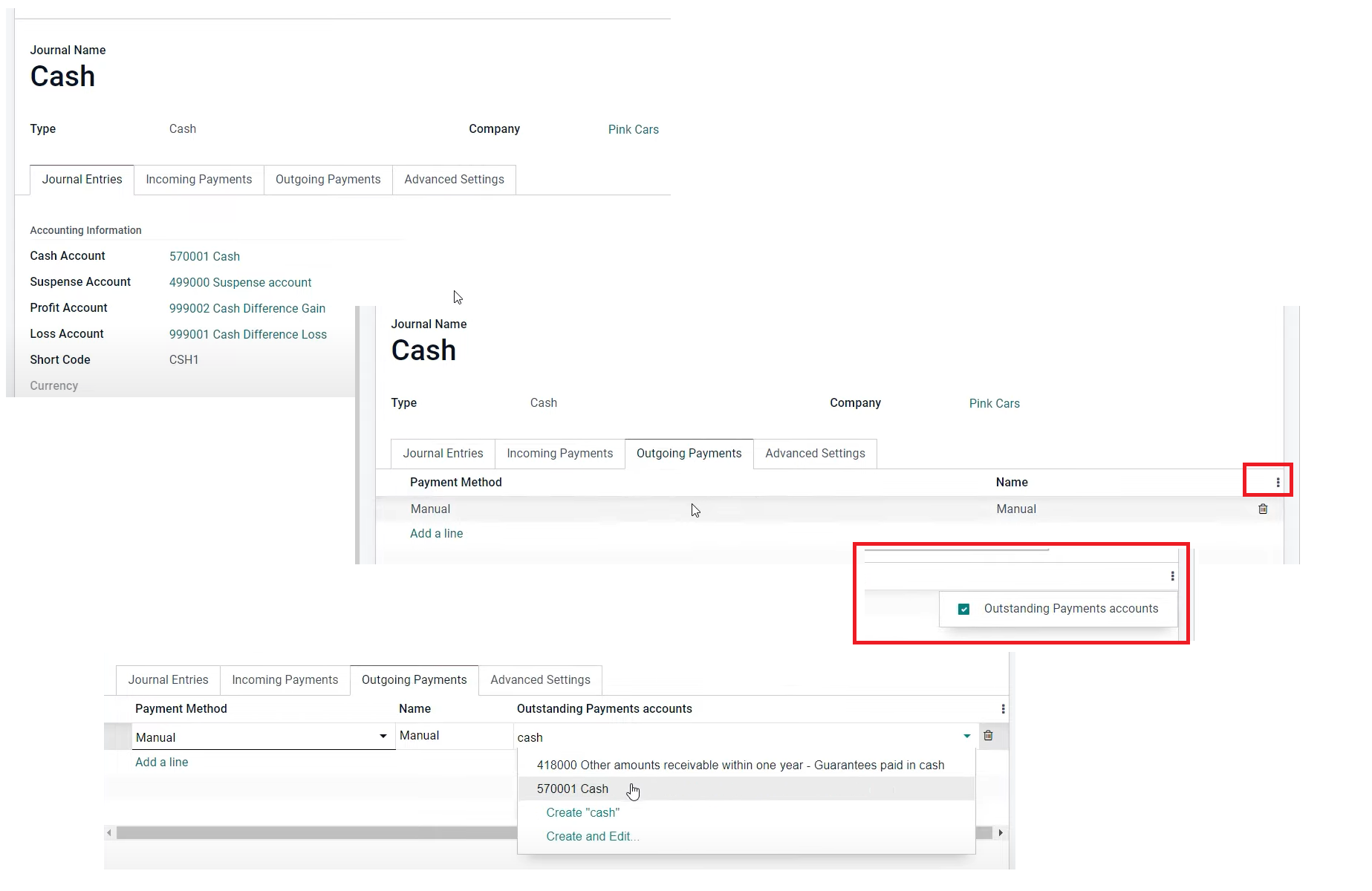

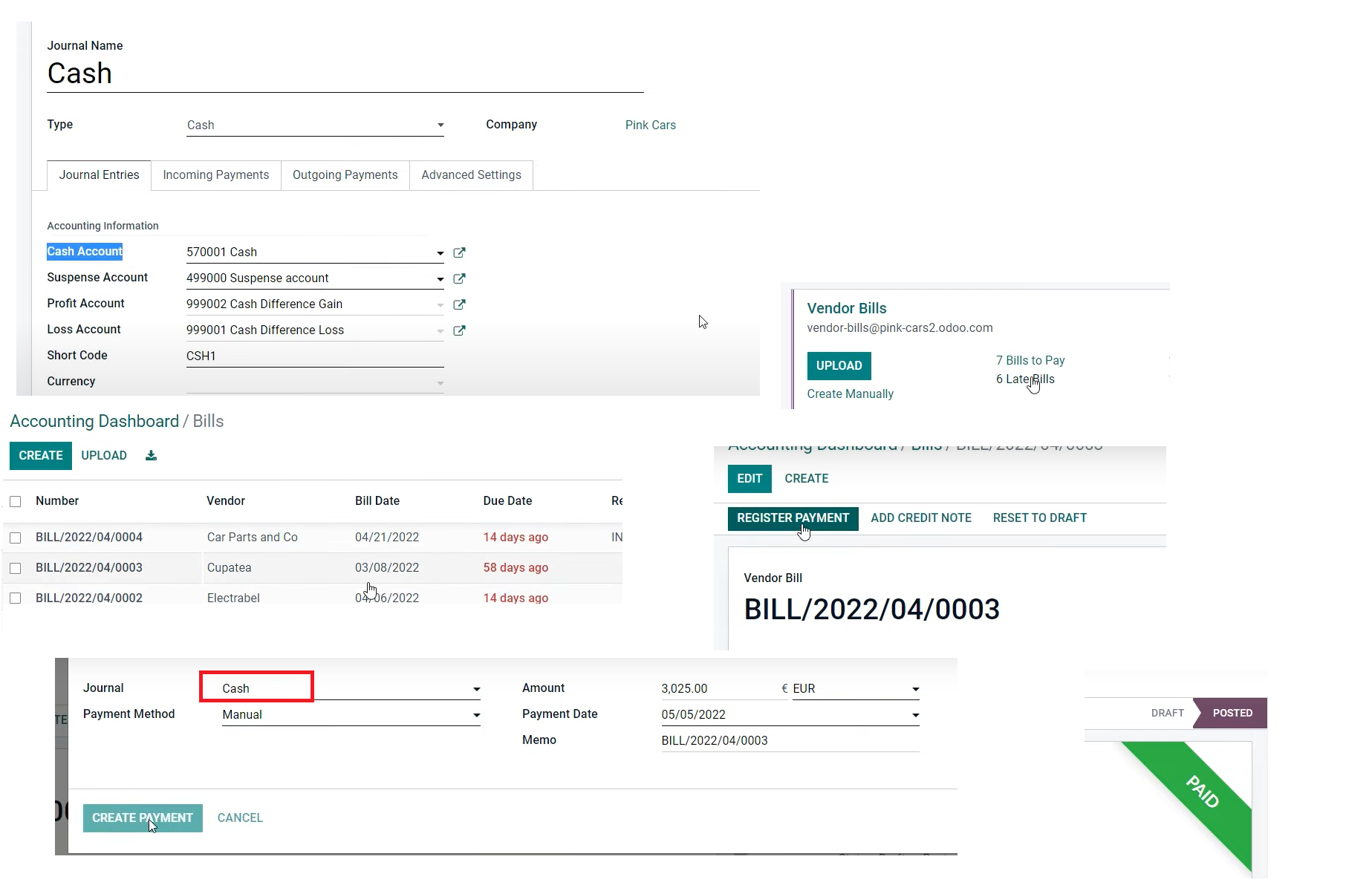

| -see items to reconcile in BNK journal -reconcile and they will disappear _______________________________ -new INV status is paid -Inpayment status applies for BNK not for Cash -set the configuration of the journal -put the default account |

|

| -put the default account _______________________________ -set accounts configuration in the journal -go to vendor bills and pay with cash -the bill gets automatically paid |

|

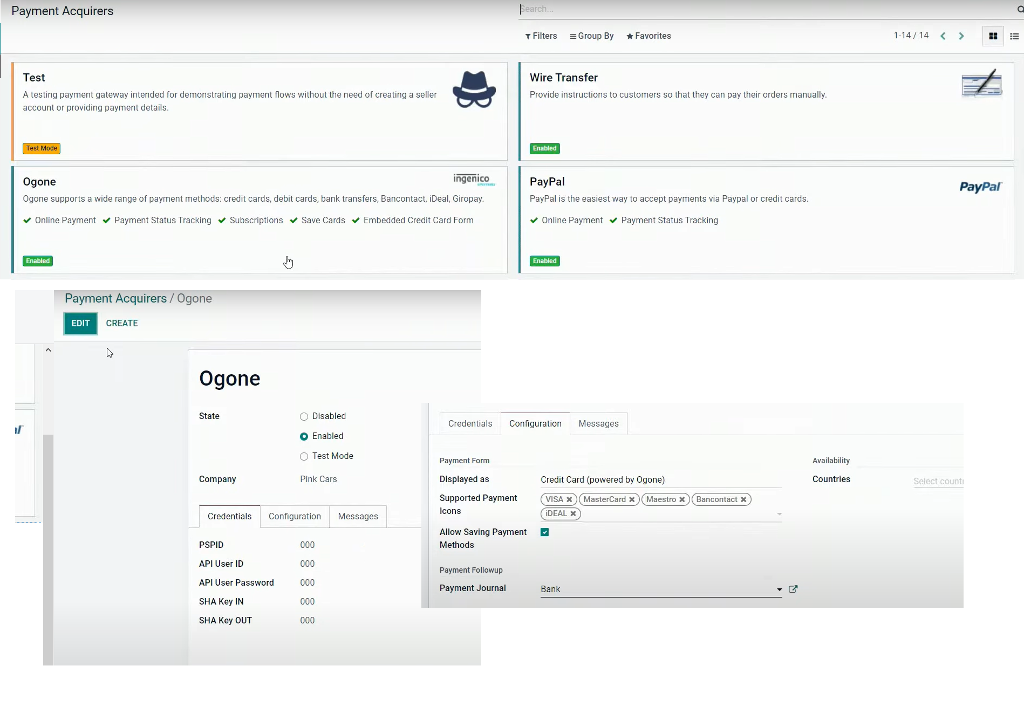

Online Payments

-Activate online PMT feature

-go to Accounting / config. / PMT Acquirers

Payments Acquirers

-select and configure the requested PMT acquirers

-put credentials

-if "countries" is left blank every country will be available for PMTs

Send PMT

-Invite customer to pay

-PMT gets accepted

Invoice in Payment

-INV status in payment

Chatter

-all info in chatter and amount due sets to zero

Smart button

-see all info in the smart button related to the PMT

Account Receivable

One side

Income Account

The other

INVOICE

PMT status - Not Paid

INVOICE

PMT status - Paid

Outstanding receipts

Not using the bank account yet, but the Outstanding receipts account configured

Receivable Account

This is the counterpart account, when the debt is completely balanced.

Then the two journal items are reconciled.

Bank statement

When uploaded every transaction is waiting to be reconciled with an open INV or BLL.

Before reconciliation each transaction entry is exactly the same.

Bank vs Suspense account: this ensures that financial reports are always updated with the bank account even if not all is reconciled.

Then every transaction is matched with the related entry the counterpart will be replaced with the chosen account.

Bank Account

One side

Suspense Account

The other

Reconciliation vs Bank Matching

Are not the same!

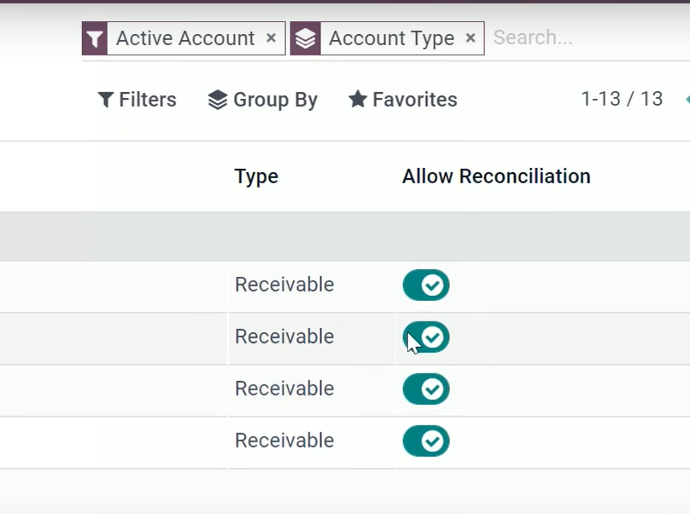

Reconciliation: linking journal items of specific accounts so the ACC needs to be the same.

Matching its credit with the debit. This process is also used outside of BNK transaction.

The basic reconciliation process does not create any journal entries.

Only indicates which journal items are related to each other..

Matching: not only to reconcile transactions with counterpart but also creates the full PMT journal entry.

Those transactions are related to INVs or PMTs. Therefore INVs will shift to the PMT status paid.

Bank Statements

Import file, enter manually or synchronize

Odoo Accounting

Match accounting records / Reconcile entries

There can be set a tolerance in percentage for reconciliations

the total amount goes to the tax report for the respective INVs

Tax period closing

Inventory Valuation

Two Methods:

-Continental: valuation of the cost is taken into account when the goods enter the stock

-Anglo-Saxon: the cost is considered when it leaves the stock

Reference: Odoo YouTube Channel

1st

INV, BLL, expenses be recorded and validated in time due

2nd

Reconcile all pending to reconcile

3rd

Ensure there is nothing in clearing and suspense ACCs

4th

Verify balance sheet items and the entries for depreciation journal entries

5th

Make sure differed revenues are correctly recorded

6th

Double check all accrued revenues and expenses

Define journals

Basic journals are:

Customers invoices, vendor bills, bank, cash, misc operations.

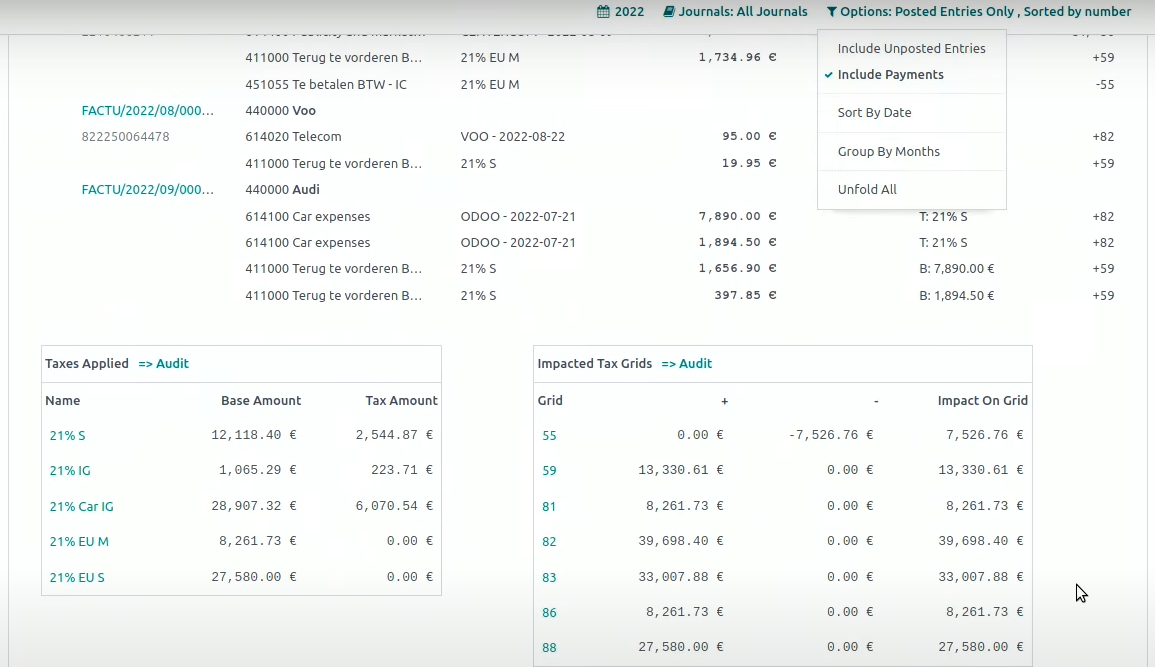

You can inquiry about posted and unposted journal entries.

In this report you can collapse or open every journal.

It is possible to dive into the journal items inside the j. entries.

Accounts can be corrected if necessary.

Vendor Items

Can view the impacted tax Grids at the bottom --> click audit --> click on a specific account and see the attached pdf bill.

Filter by journals

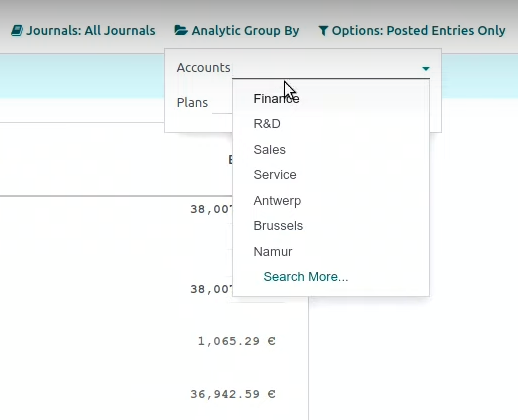

Analytic accounts can be set by a company department, cost center or location for example.

Can jump from the journal report to the profit and loss report.

Go to the general ledger - detail from there each journal entry.

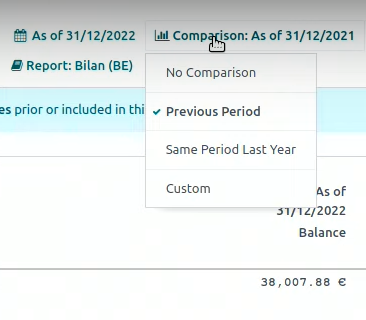

Balance sheet

Select view by localization country (fiscal position) or generic. Make a date comparison.